ALPHA V10

10 weeks of weekly Alpha Summary. It’s crazy. We’ve come along way on Alphas.

Gm Slytherins. Alpha 👇🏻

Defi

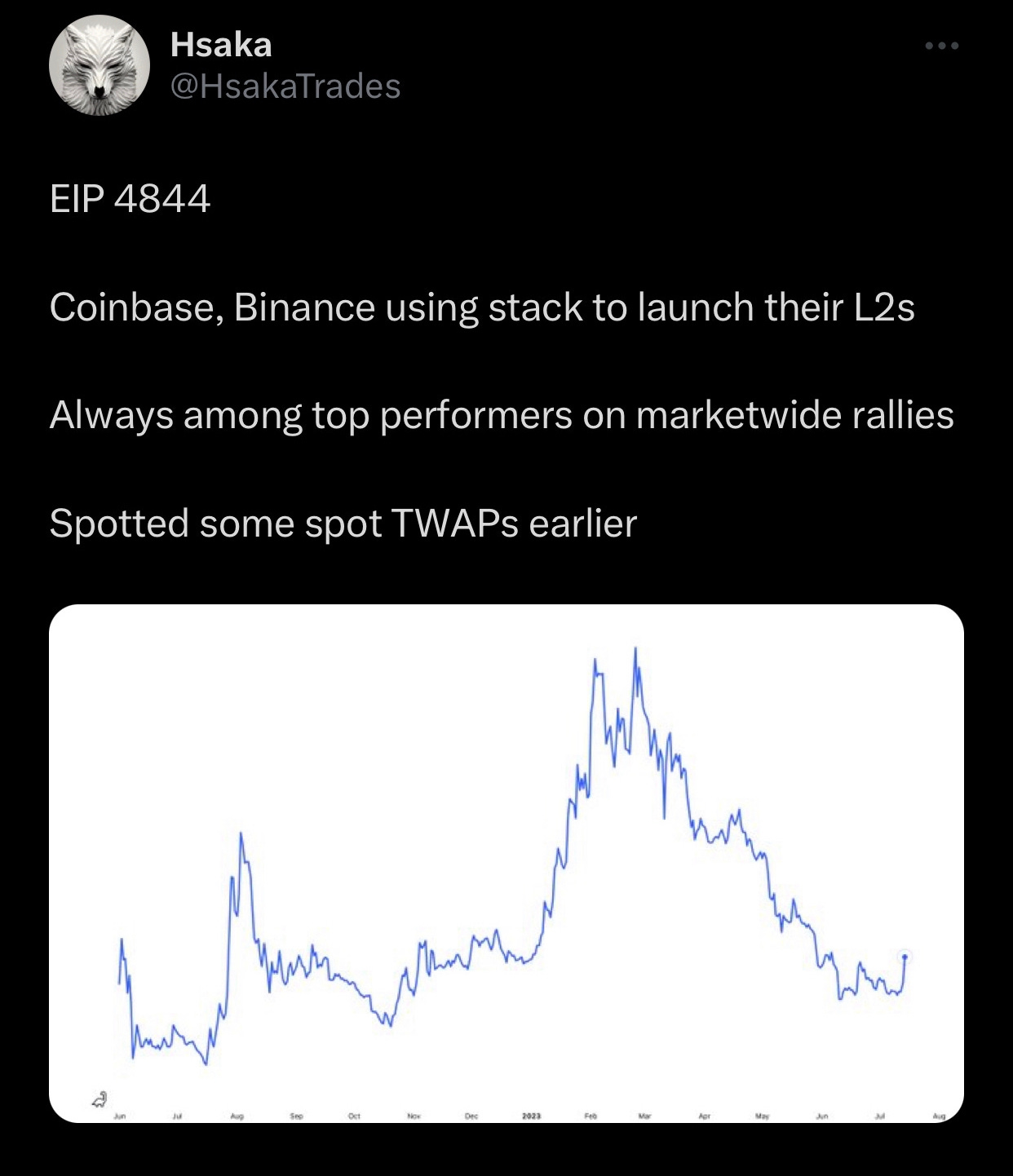

A lot of buzz recently on EIP-4844

Gas fees on Rollups will be reduced by a mile. Reduced fees, increased network activity

OP stack situation and why I’m bullish on $OP

OP stack chain, Base mainnet in August.

A lot of chains choose Op 👇🏻

Scope of Base and it’s ecosystem

OP native Velodrome bullish thesis.

And hint: Velo lockets get Base native - @aerodromefi airdrop

Although will velo dip at airdrop?

Might get aero at open market

Just recently, Celo formerly L1 proposal to be ETH L2

Soon most all L1s will transition to L2s

Two bad news for L1s DOT and Algorand

Algorand’s num1 defi protocol shuts down and DOT stops its Parachain.

You see, you know what it signifies!!!

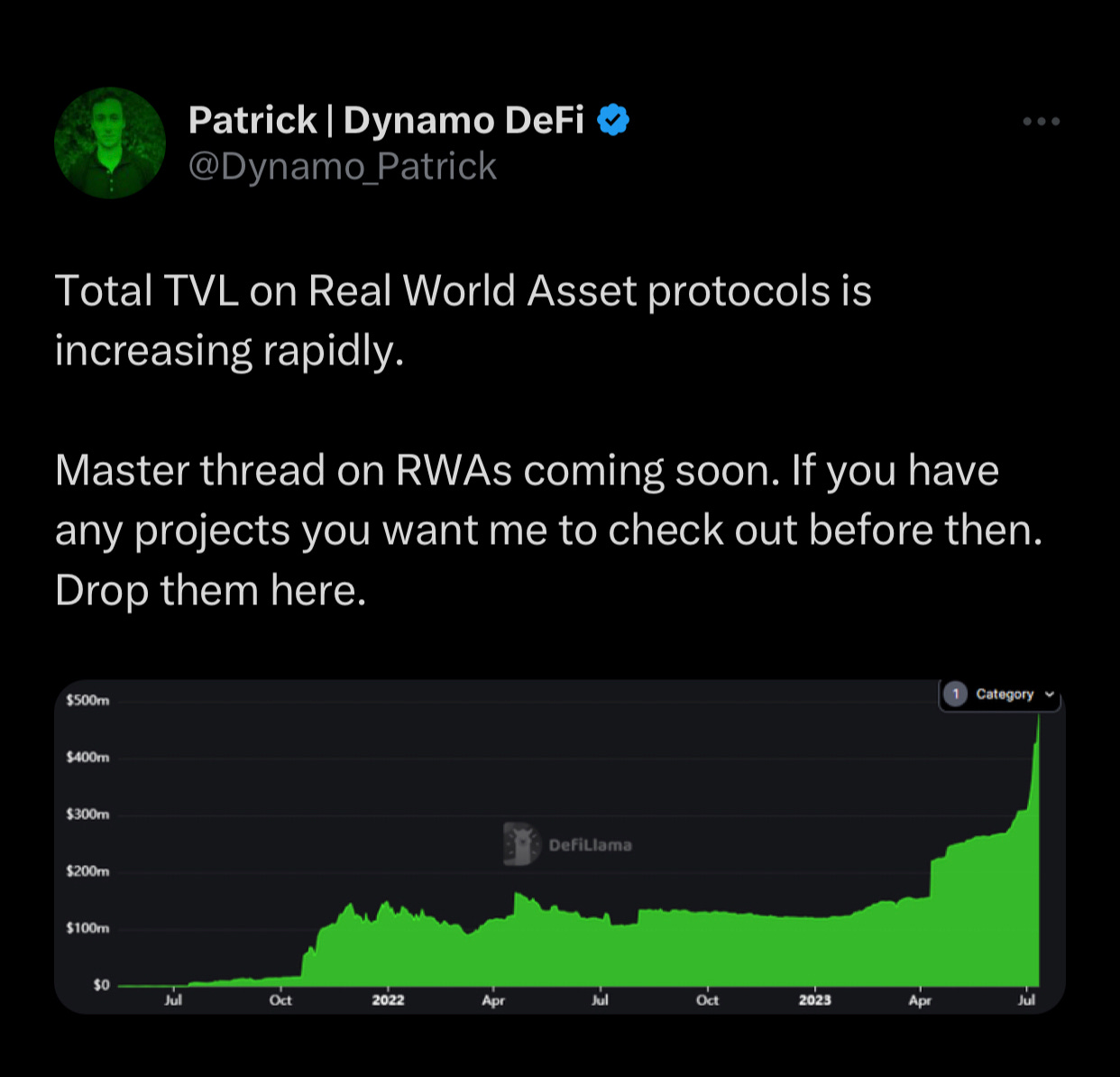

RWA bidding will come from ze tradfi

It’s what they like, Real World! Then tokenized

They cherish this

With BlackRock bidding $BTC. Smart investors saw the need to bid RWA.

RWA rose in TVL and more

6 days ago some activity happened on $Metis, idk what that is

Who can tell me what’s happening there?

Everything you need to know on ETH L3s

Oke ending all talks on L2 with this detailed dive on state of L2s

oke time for some yielding

swETH as collateral on @gravitaprotocol

Also Guide to Maximize your swETH yield.

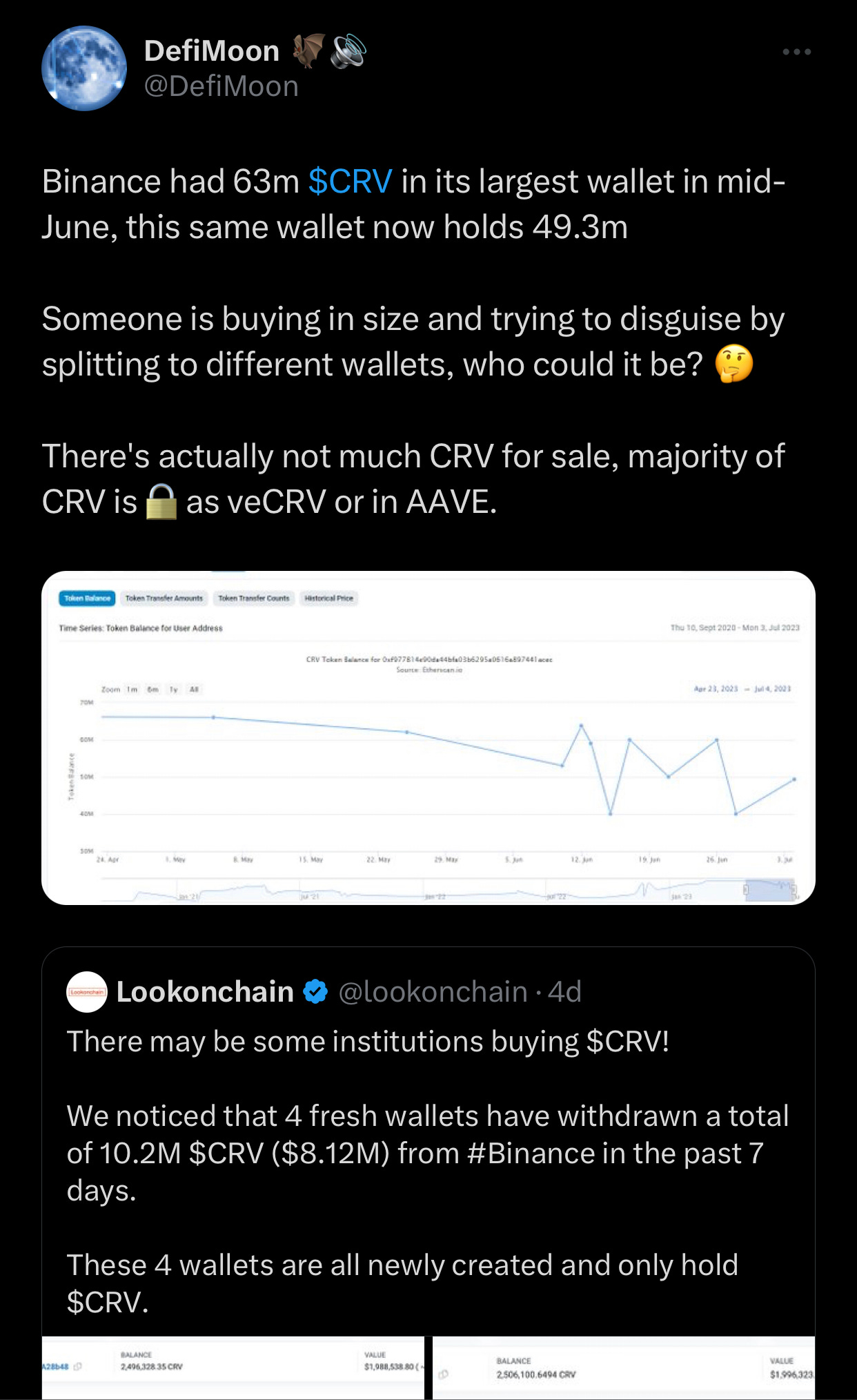

Institutions maxbidding #CRV

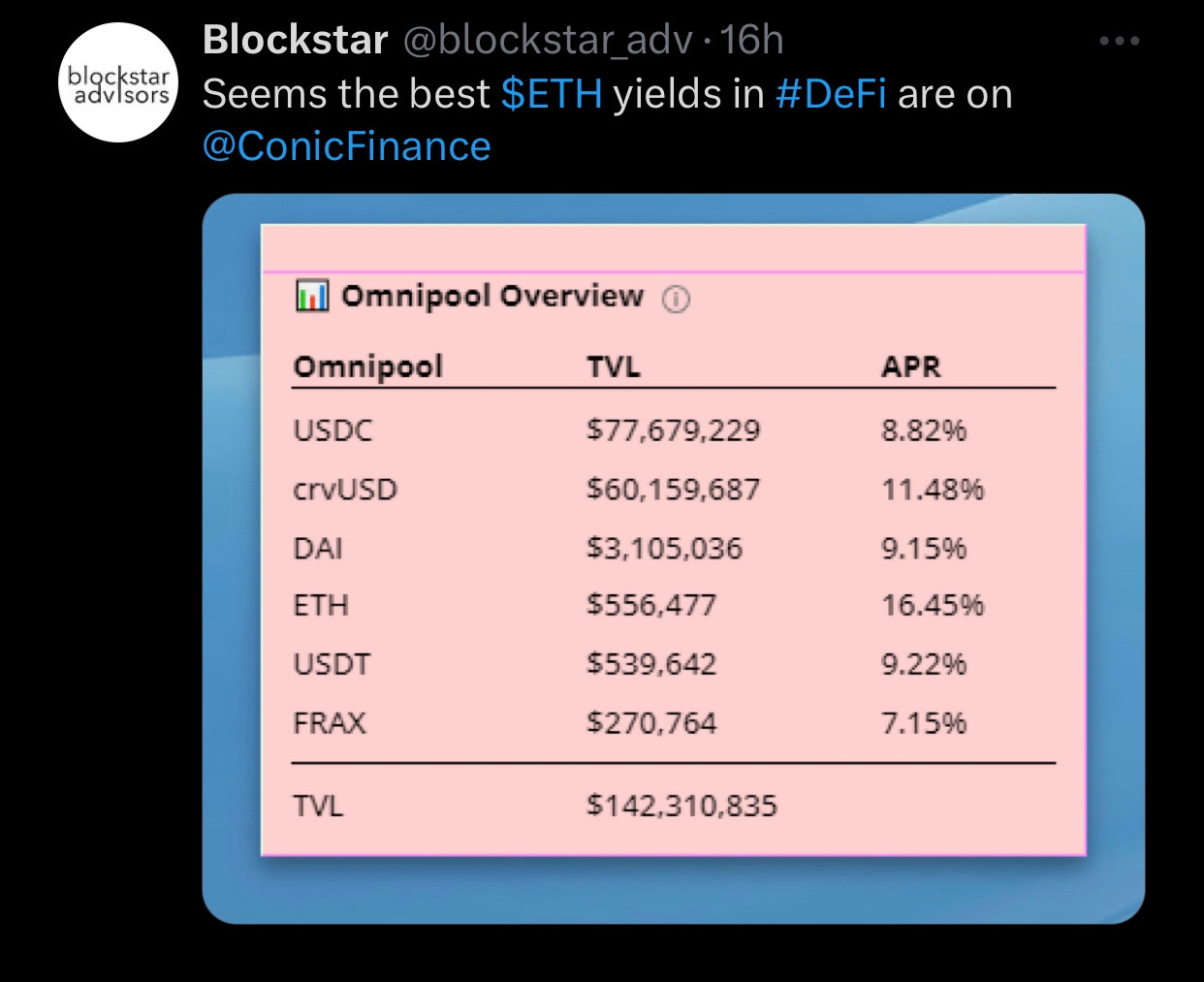

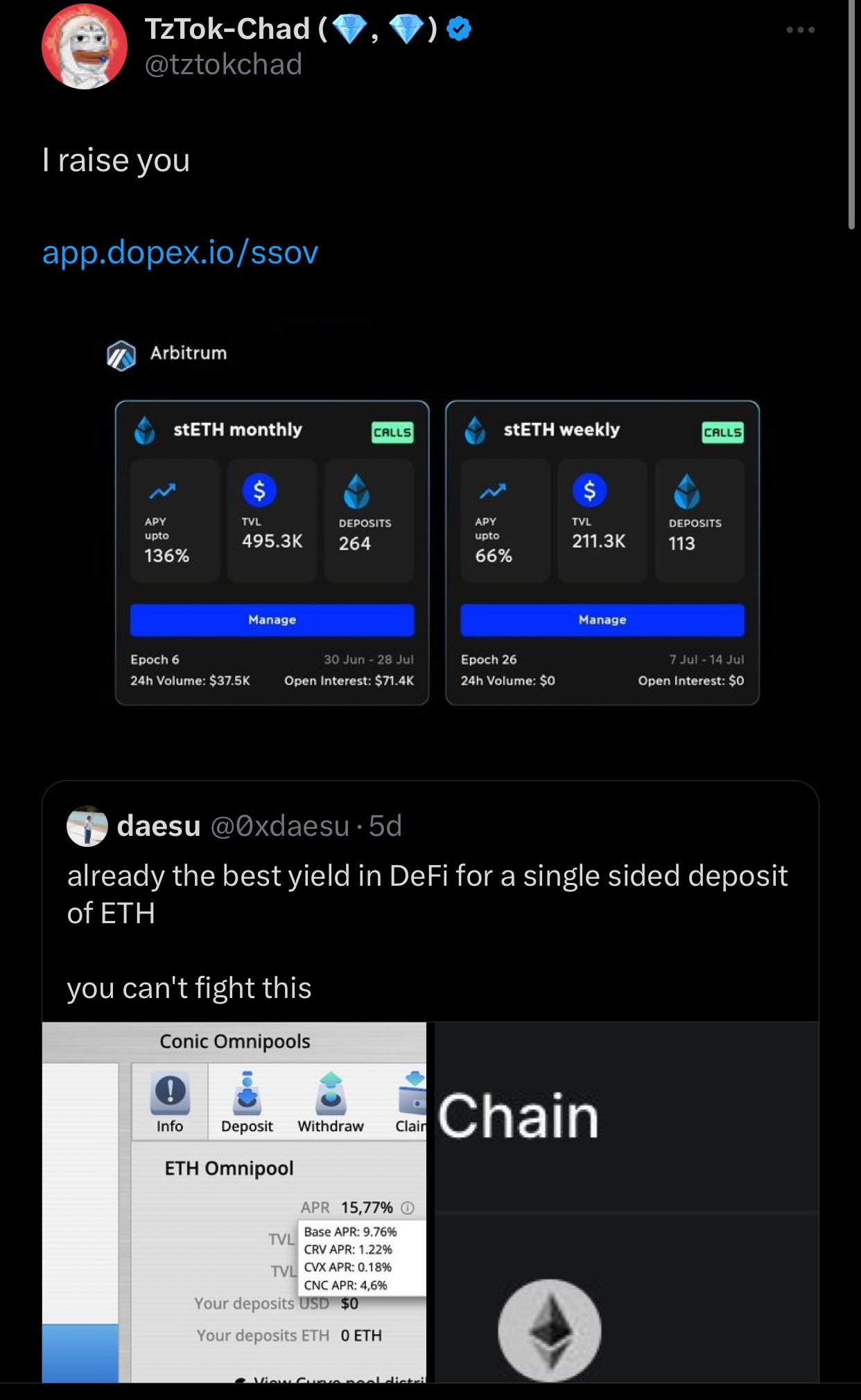

With the launch of $ETH ominpools.

Having one of the best yields for single staked assets in whole eco

#CNC is bidding.

However, instead of staking on Conic, if staked via Beefy vault your rewards (CRV, CNC, CVX) are auto compounded to earn passive ETH

But alternatively, Dopex gets a higher yield on single staked stETH

Risk averse strategy to earn 34% APR on Timeswap using $Quick/$USDC pool

Also, timeswap testnet is live on Mantle

Remember by lending and borrowing on Timeswap you position for an airdrop

Unami enjoyoors $glpUSDC-$USDC pool on Timeswap. Timeswap has so many yield strategies

Parallax 25% APY rETH-wETH vault

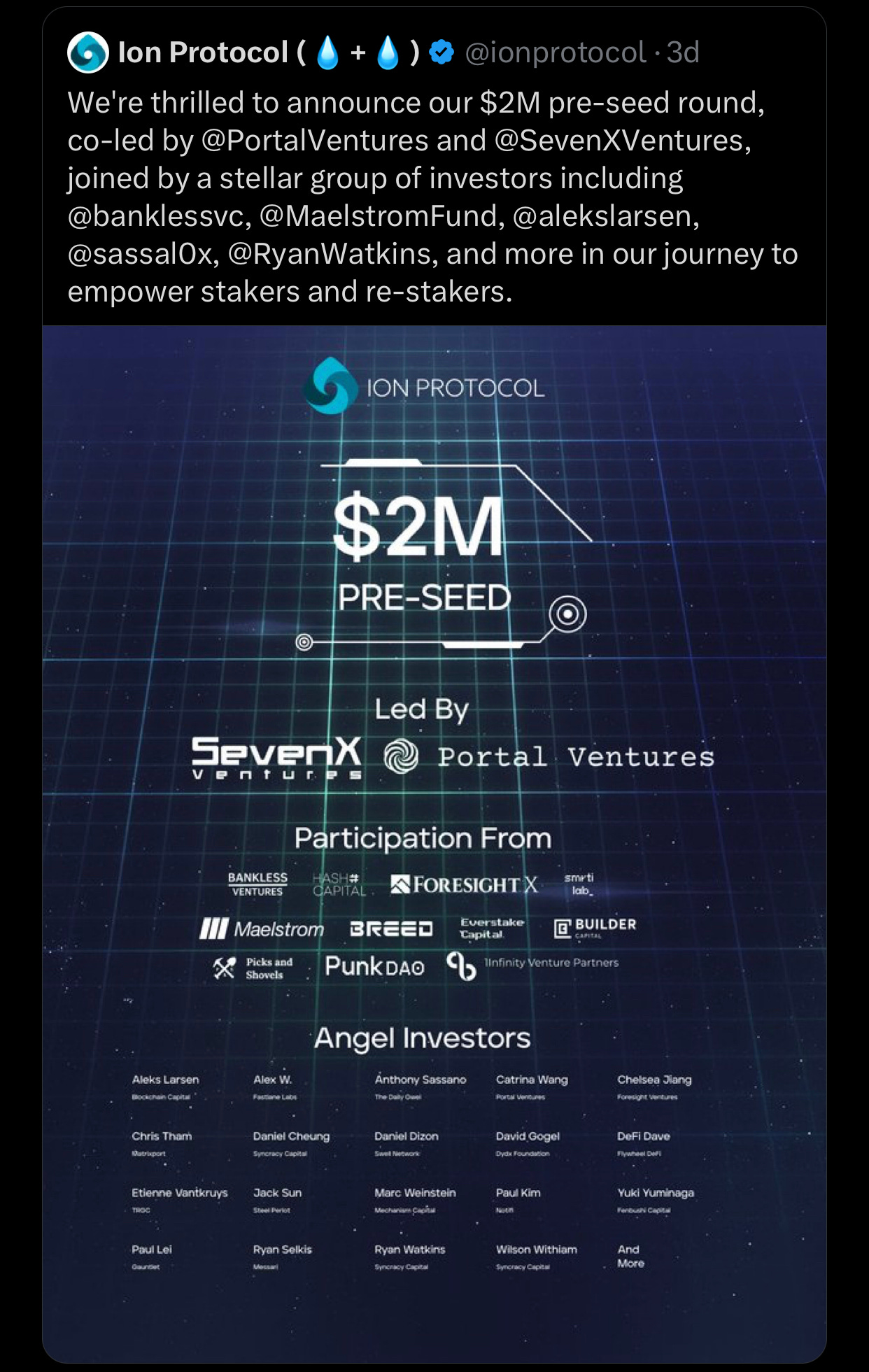

Rumors have it that @staderlabs_eth will start a LRT (Liquid Restaking Token) with @eigenlayer

6 days ago Stader Labs went live on mainnet

Expect $RBN to bid.

Ribbonfinance going through a revamp proposal (improved UX, Gud yields etc) which they’ll vote yes obviously and integration with fellow options Aevoxyz

4 days ago EigenLayer LST cap was raised and quickly filled out

And new liquid Restaking protocol powered by EigenLayer @restakefi

Also, Altlayer chooses Eigen for security

Formerly crocswap, now ambient. Been building Ambient since I thinks ‘20.

Now launched and backed by major VCs, as it aims to redefine defi

Reasons why Camelot Arbitrum grant proposal is bad

GHO stablecoin live on Aave

Gud Aave eco catalyst

Synapse bullish thesis

A new Mega LSDFi Protocol

Recently Polygon announced $POL as its token for Polygon 2.0, exing $Matic

Some mega Alphas

6 days ago Rodeo was exploited

However, it might have a comeback

Bull run pumpamental thesis

GameSwift $GSWIFT utility. Will launch on Spartadex_io launchpad and Bybit

Binance LSDfi report

AI

Use AI to make some money on Youtube

Chatgpt for defi

State of the Market

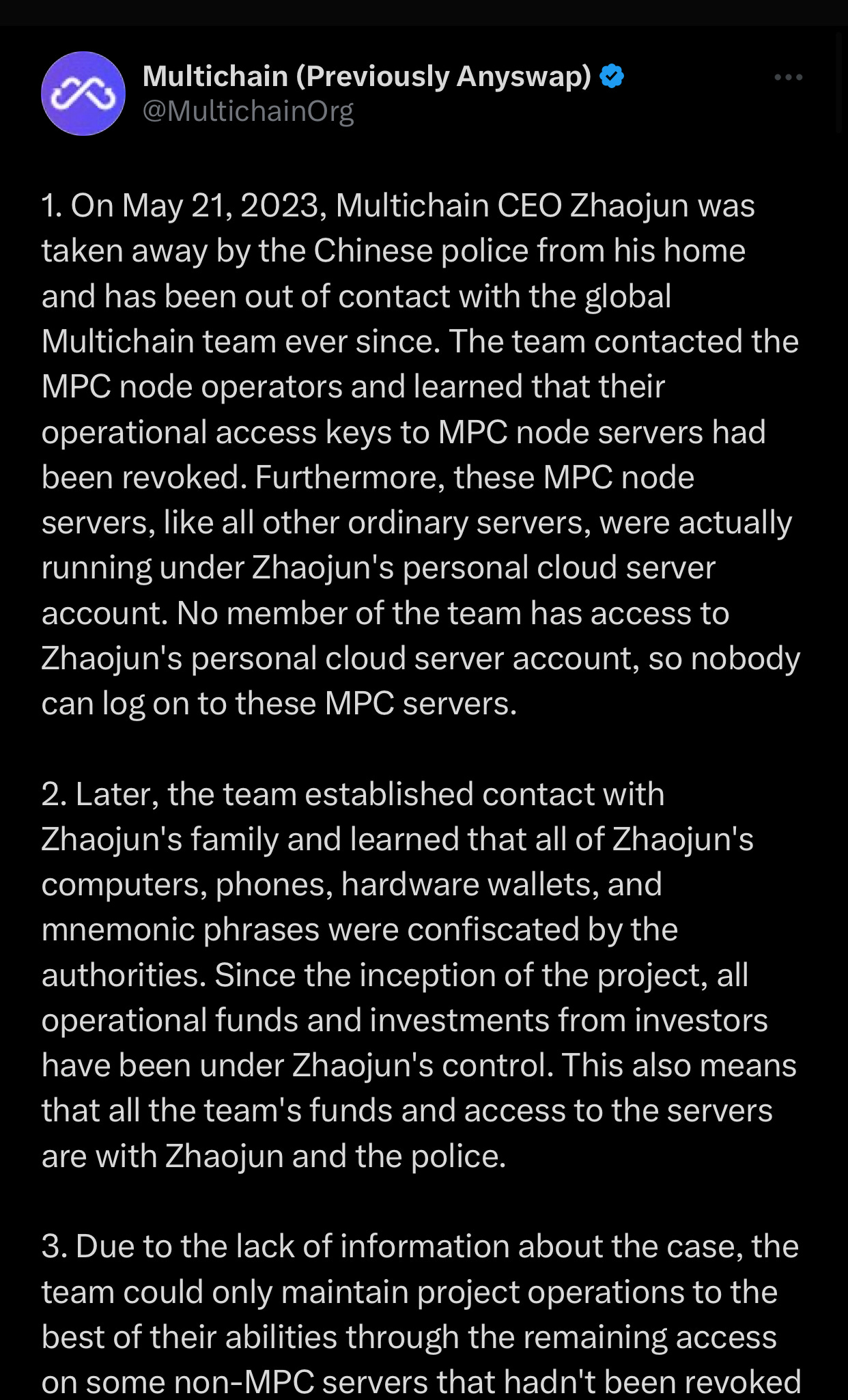

Ceo and some of his family members were arrested by Chinese authorities.

Loss of contact with Multichain team; team lost access to serves.

Users assets transferred to unkown addresses.

Elon Musk handed out rewards to Twitter creators.

Here’s everything you need to know on it

XRP is not a security- US Judge

Everything you need to know on the Ripple $XRP case

Good accumulation zone to load up bags

Ze end 🐍