Arbitrum Price Prediction backed with Data and Maths

In this article we’ll discuss these:

- Intro

- Utility

- Tokenomics

- Why Arbitrum is superior

- Comparison with L2 tokens

- My price prediction is backed by data and mathematics.

Intro

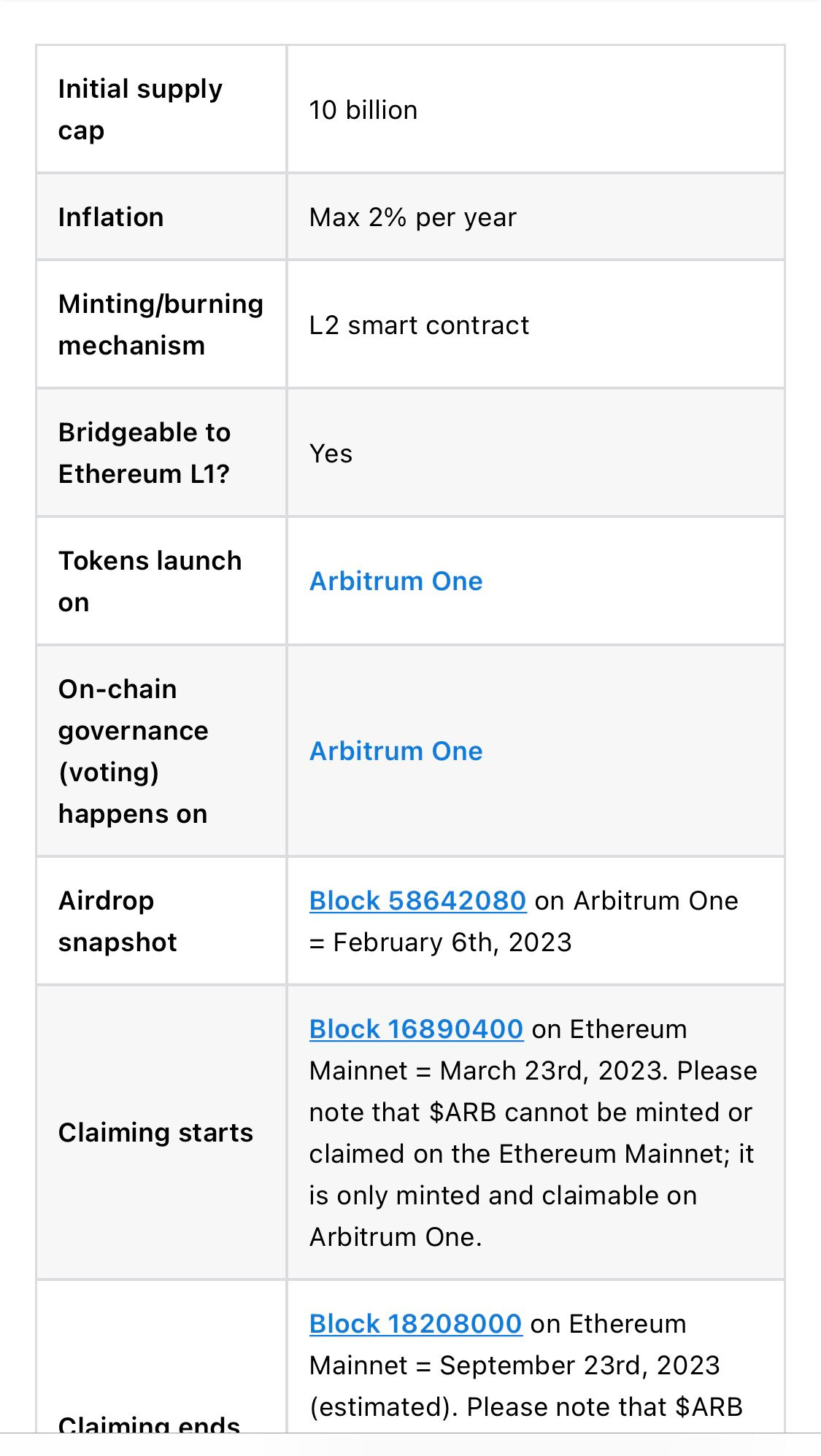

The Arbitrum Foundation took a snapshot of active users with the aid of @nansen_ai. People who used Arbitrum anytime before February 6th, 2023 (exactly block 58642080) on Arbitrum One are eligible for the airdrop.

Utility

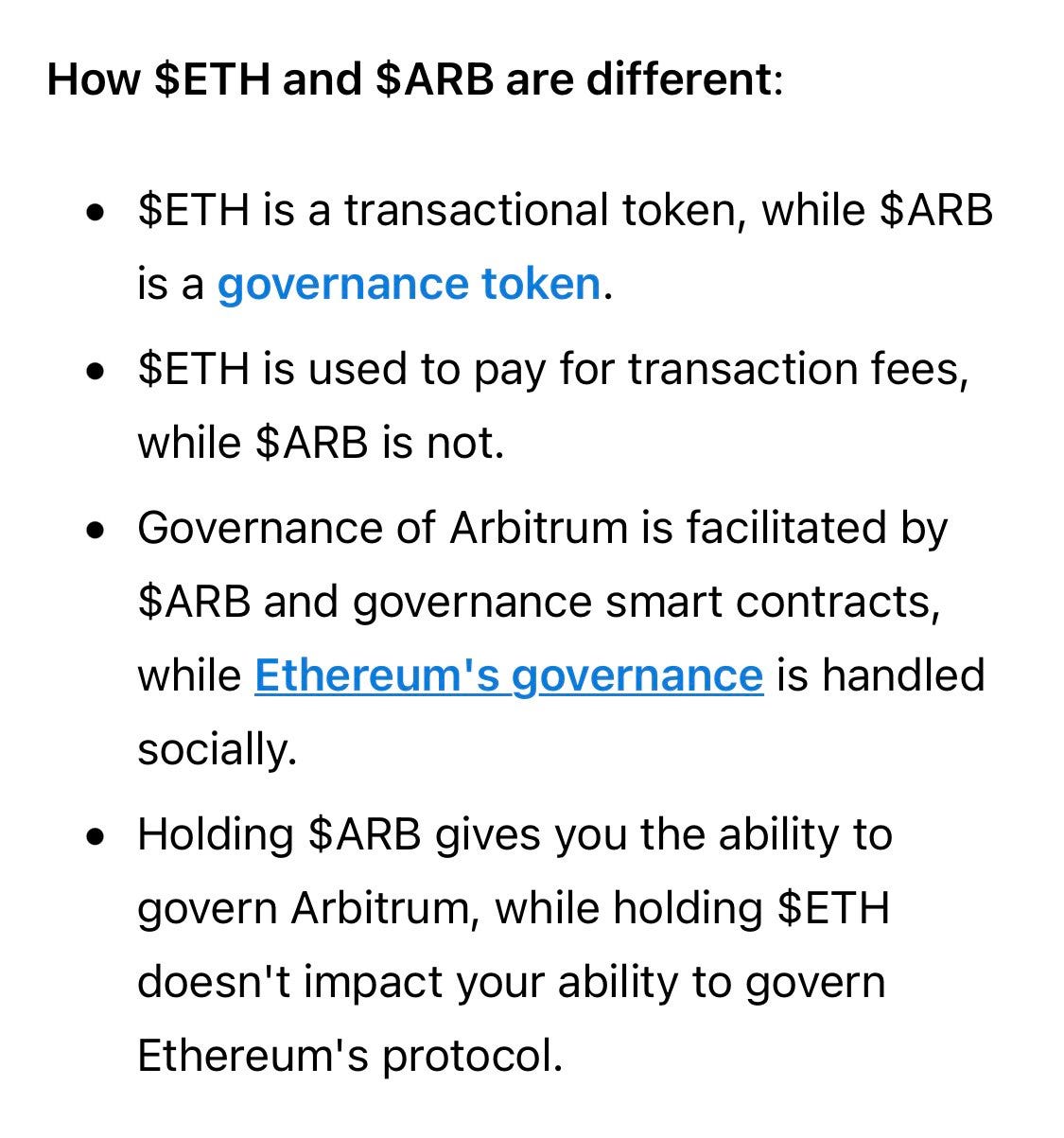

The Arbitrum token is primarily and solely a governance token, nothing more, nothing less; maybe another utility can be added in the future. Arbitrum token holders are part of the Arbitrum Dao, which governs two chains: Arbitrum One and Arbitrum Nova.

Arbitrum One is fully trustless and inherits ETH base layer security, making it good for defi. Nova has cheap transactions good for gaming.

Tokenomics

This is Arb’s tokenomics

👇🏻

It has a max of 2% inflation/yr.

Tokens launch in Arbitrum One, and claiming ends on Sept 23, 2023. Investor and team tokens are locked for a 4-year period, with the first unlock happening next year and other unlocks in the months after next year. That leaves 2 token allocation.

The dao allocation and airdrop user allocation. Arbitrum created a 2nd mechanism to reward its users—those who used Arbitrum newly (after feb 6) and those who weren’t rewarded but felt they needed to be. Arbitrum decided to allocate its community (DAO airdrop). Only projects with arb dao treasuries were allocated these tokens for their community.

The aim of allocating these tokens to these projects is token distribution to their community.

For Arbitrum projects that didn’t make the cut; you’ll be rewarded too.

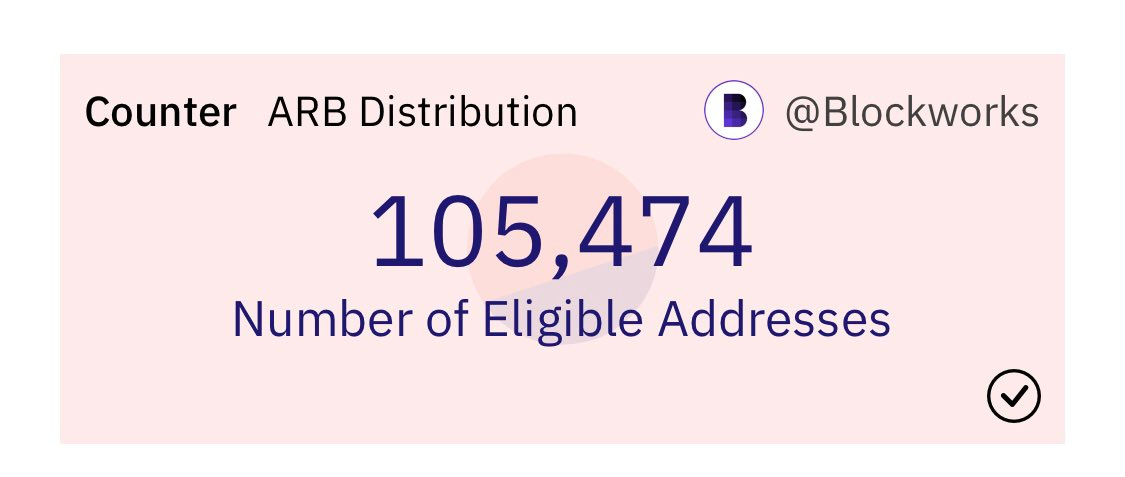

This leaves us with 1.162bn tokens to be airdropped to 105,474 addresses.

Why Arbitrum is superior

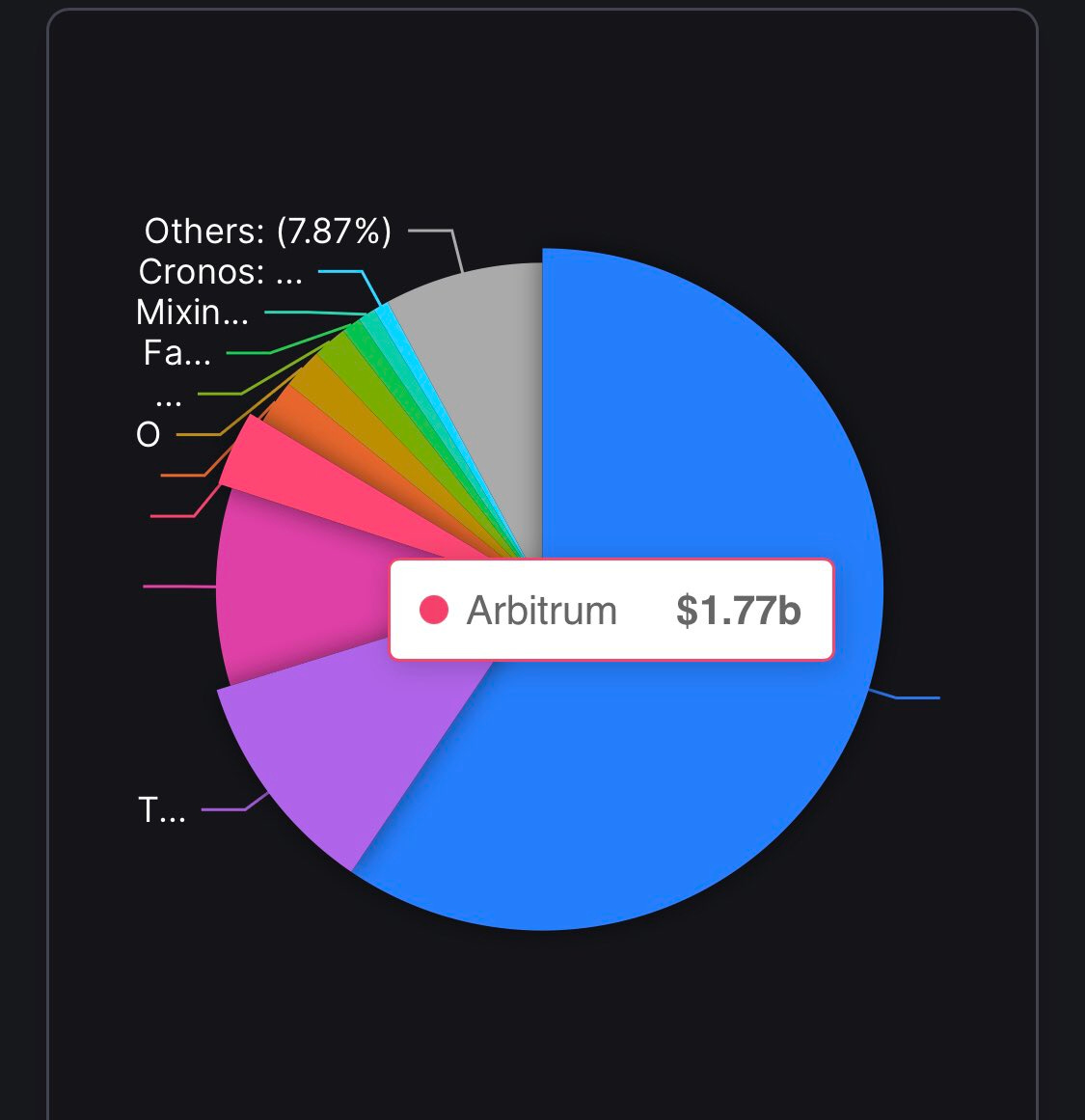

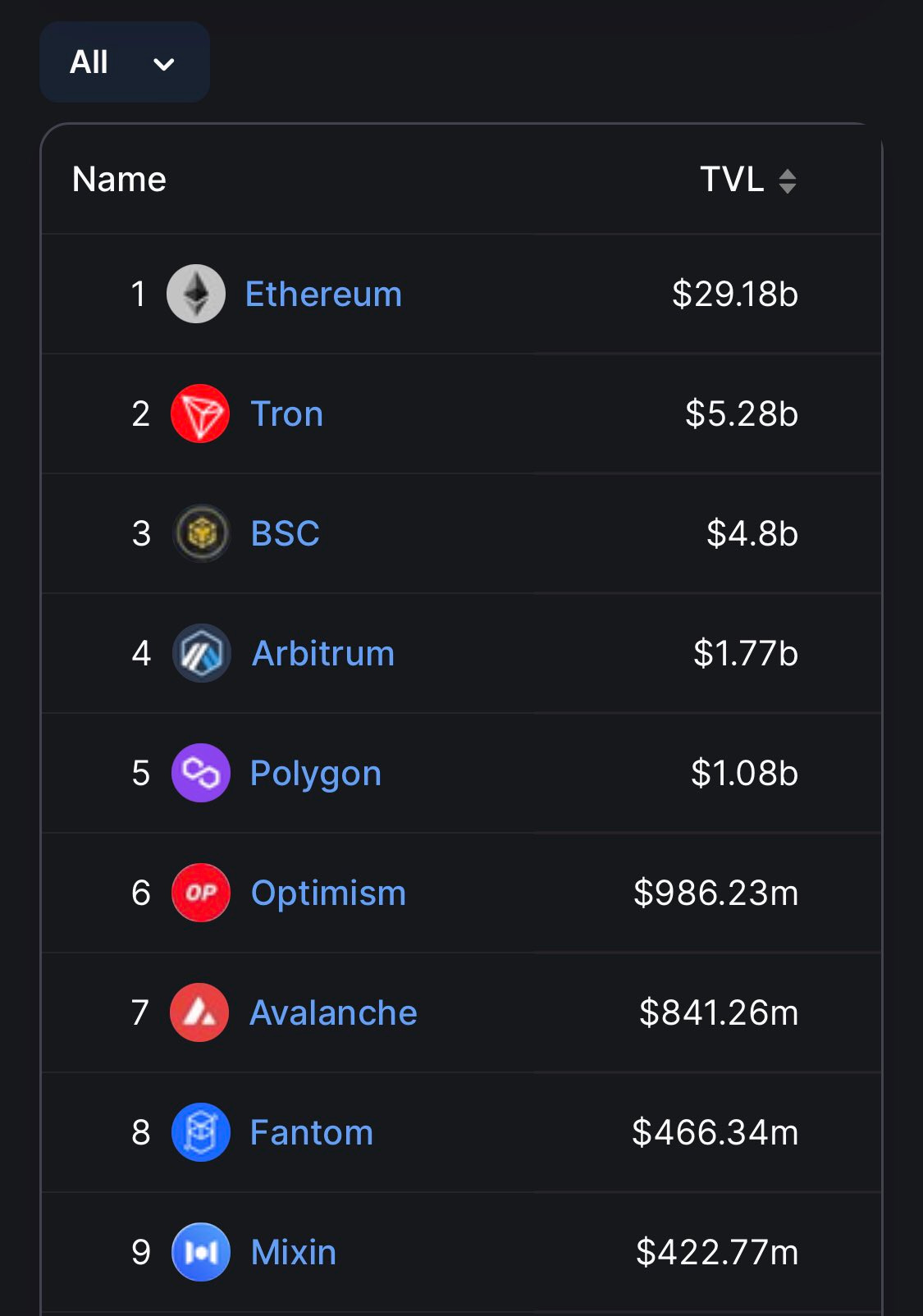

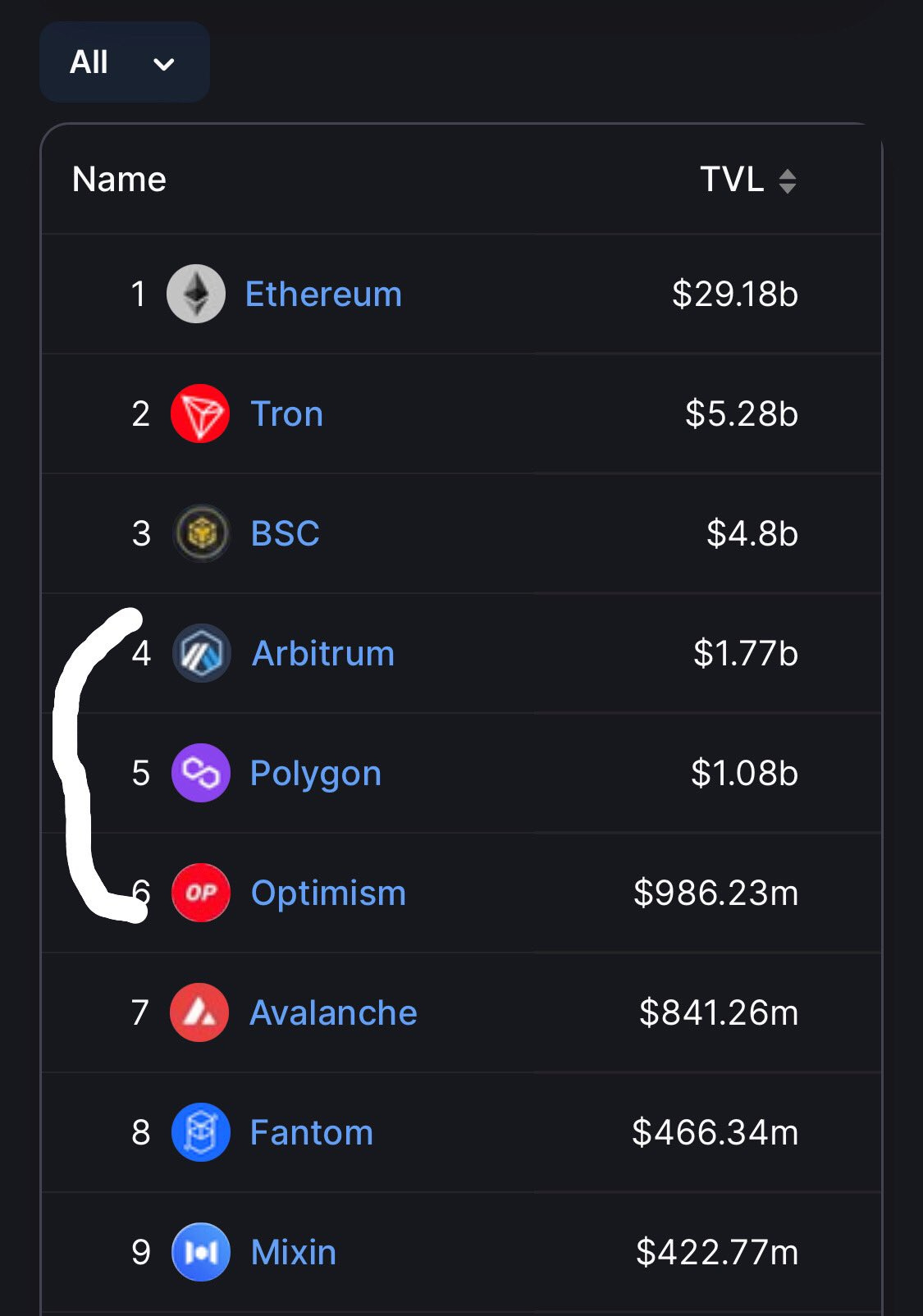

How strong is Arbitrum? Very strong considering its adoption and usage. Yes, it’s the 4th largest chain in TVL; only bsc, tron, and ETH are above it. TVL denotes the adoption and usage of a project.

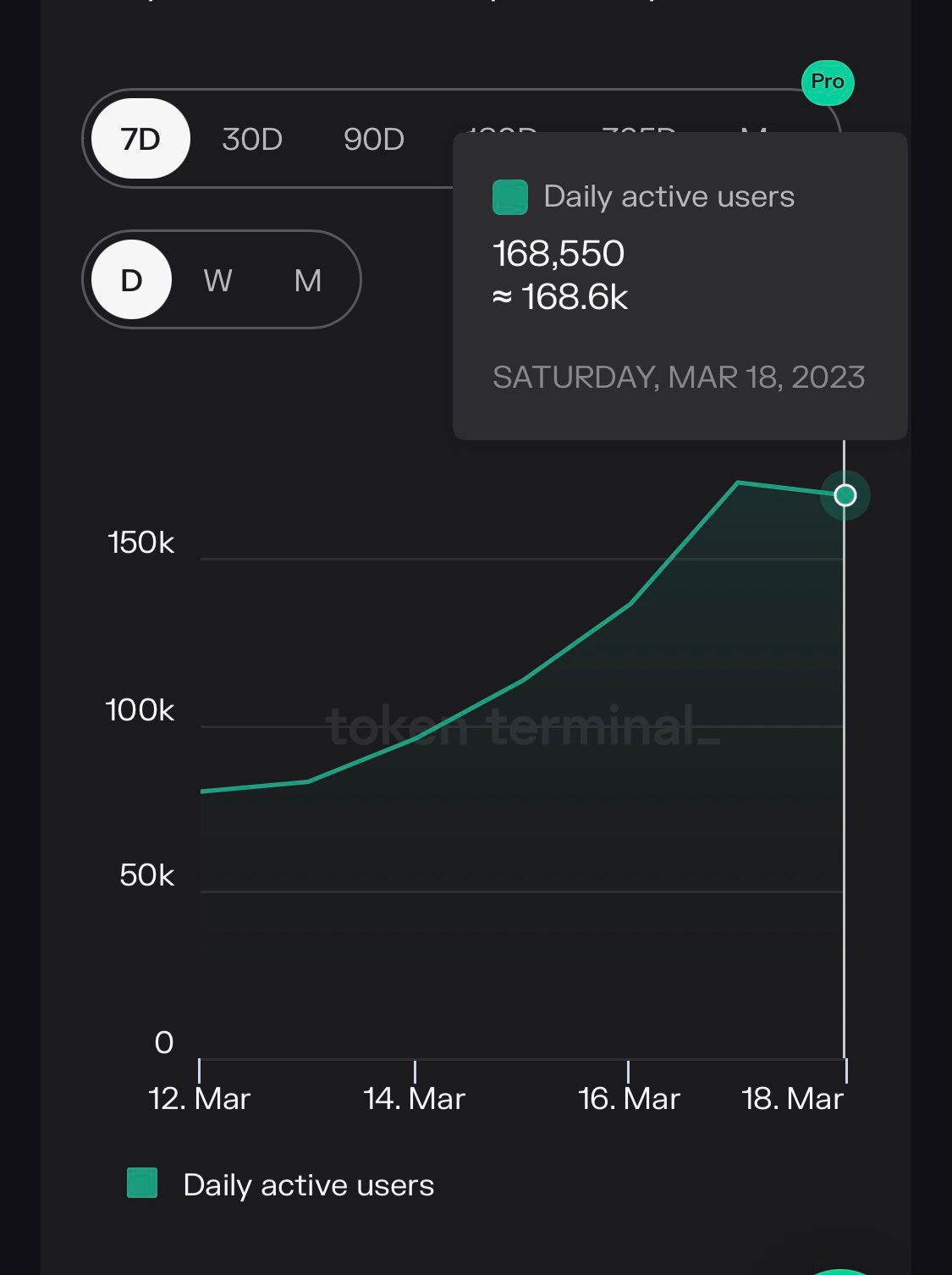

Usage? Okay, let’s see things for real. The daily active wallet users in 7 days are on an upward trend; airdrop farmers, who? The date of the announcement was March 13th, and at the moment, the number of active wallets has doubled.

Comparison with L2 tokens

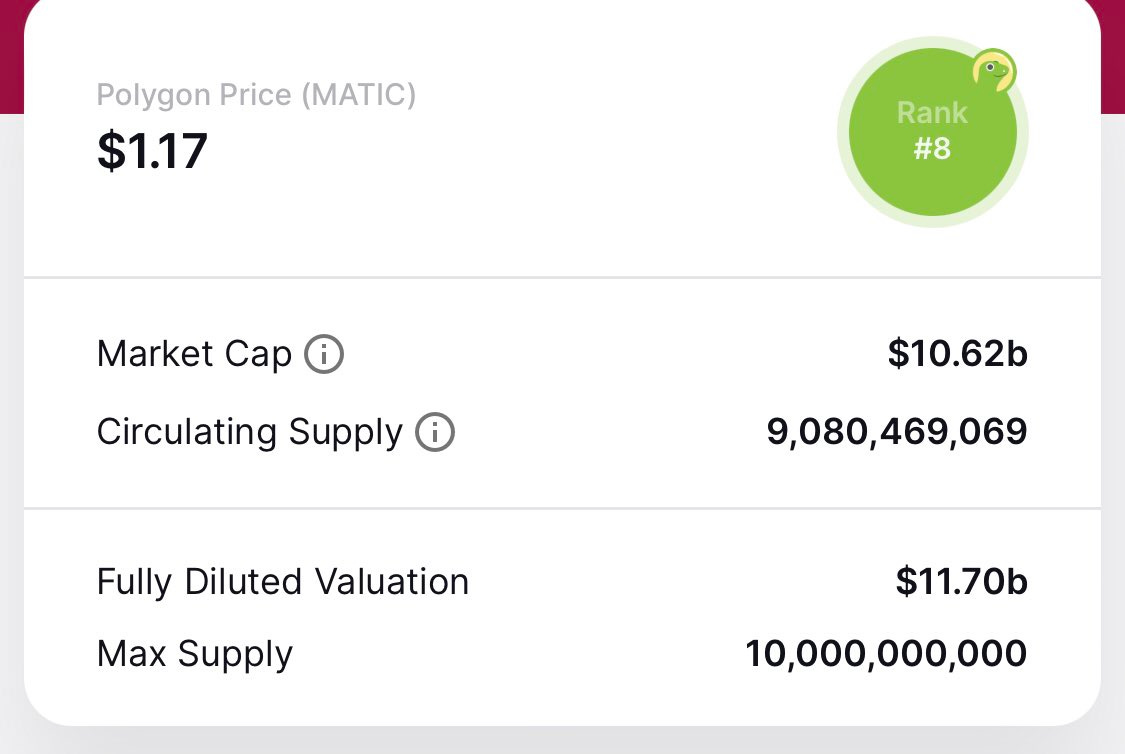

Previously, I wasn’t going to compare Arbitrum to its L2 compatriots because of different tokenomics design. Polygon PoS for example is a sidechain and different tech from Arbitrum and its token Matic is used for staking and gas fees; it also has a burning mechanism.

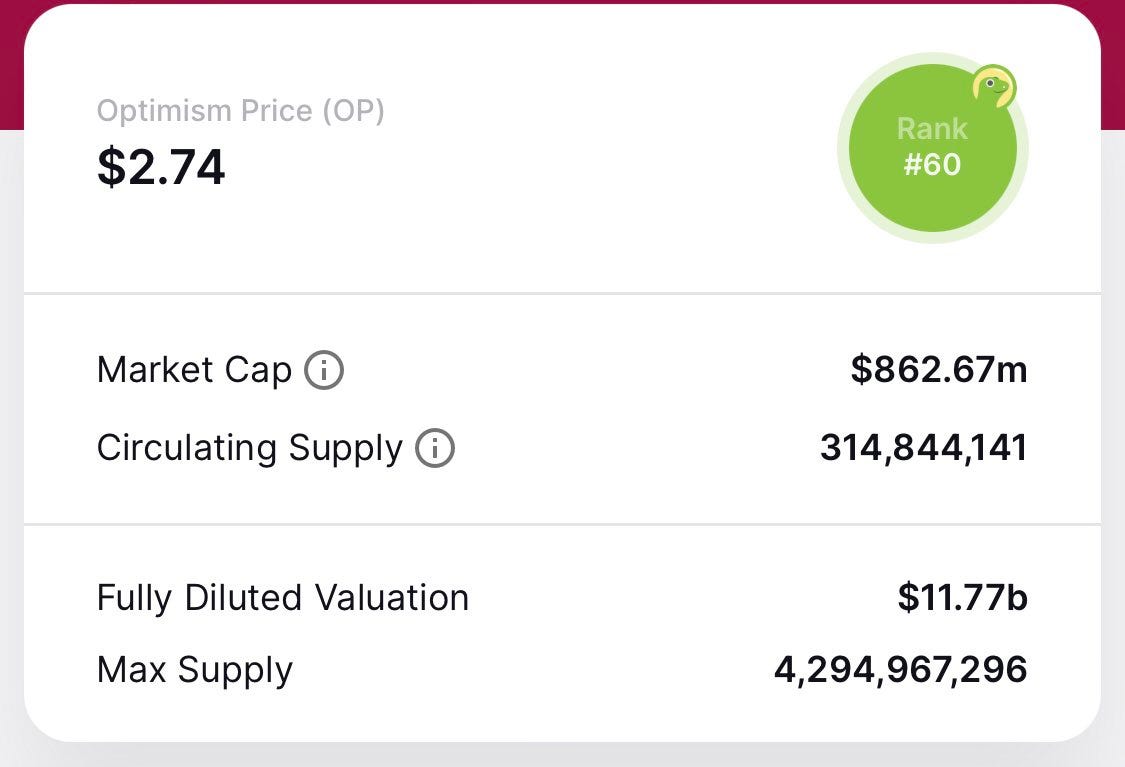

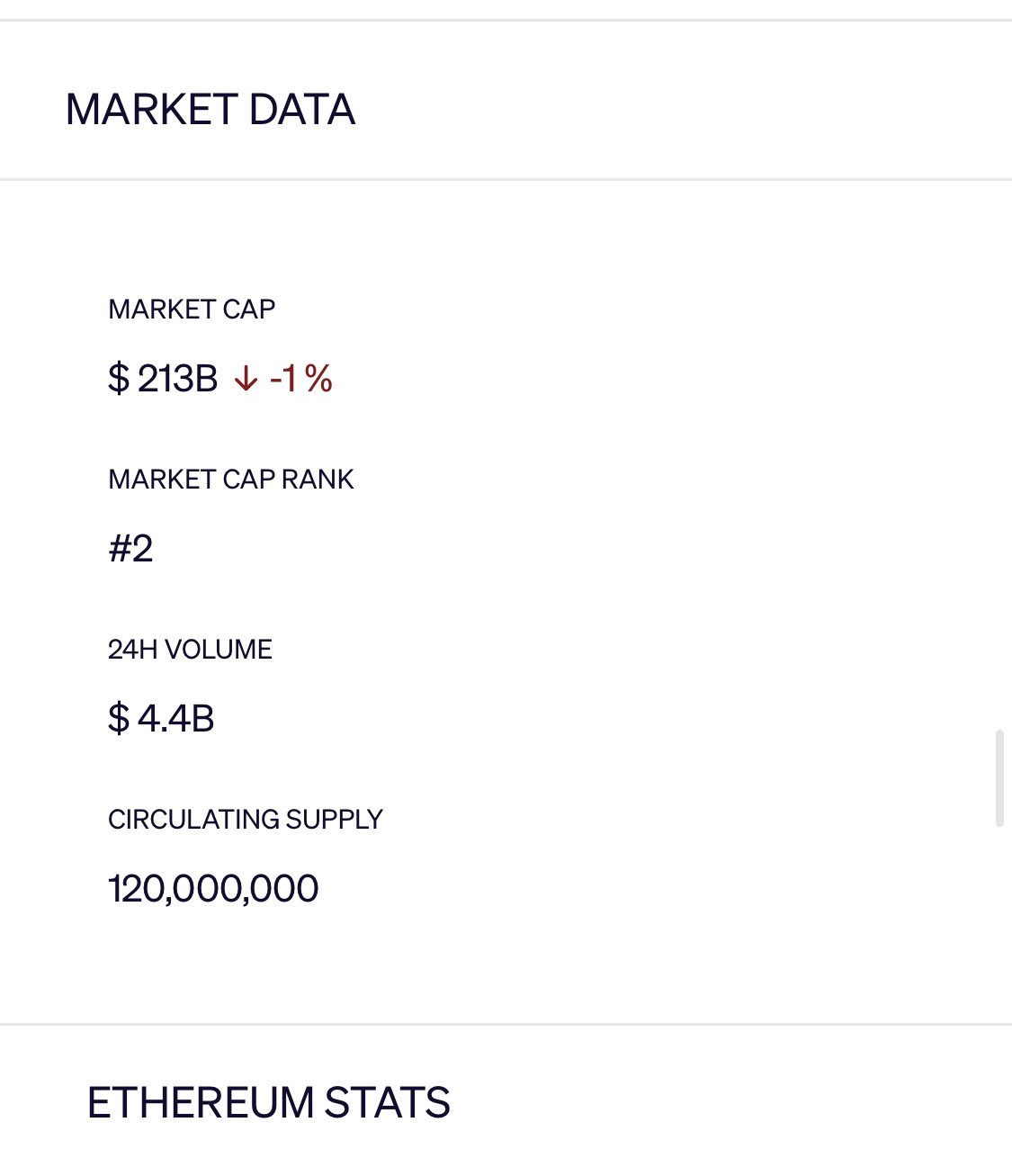

This is unlike rollups today, which use ETH for gas and token for governance. But burning reduces supply; currently, the supply of Arb is low and the value is governance, whereas Polygon’s is gas. Hence, I chose polygon and Optimism.

Why? Similar tokenomics, both L2s and very close in TVL.

Why isn’t BTC up there in TVL? BTC is more like a meme coin and a p2p coin. Recent developments like ordinals and stacks are helping it, though. EVM chains deal with value usage.

Now, let’s proceed

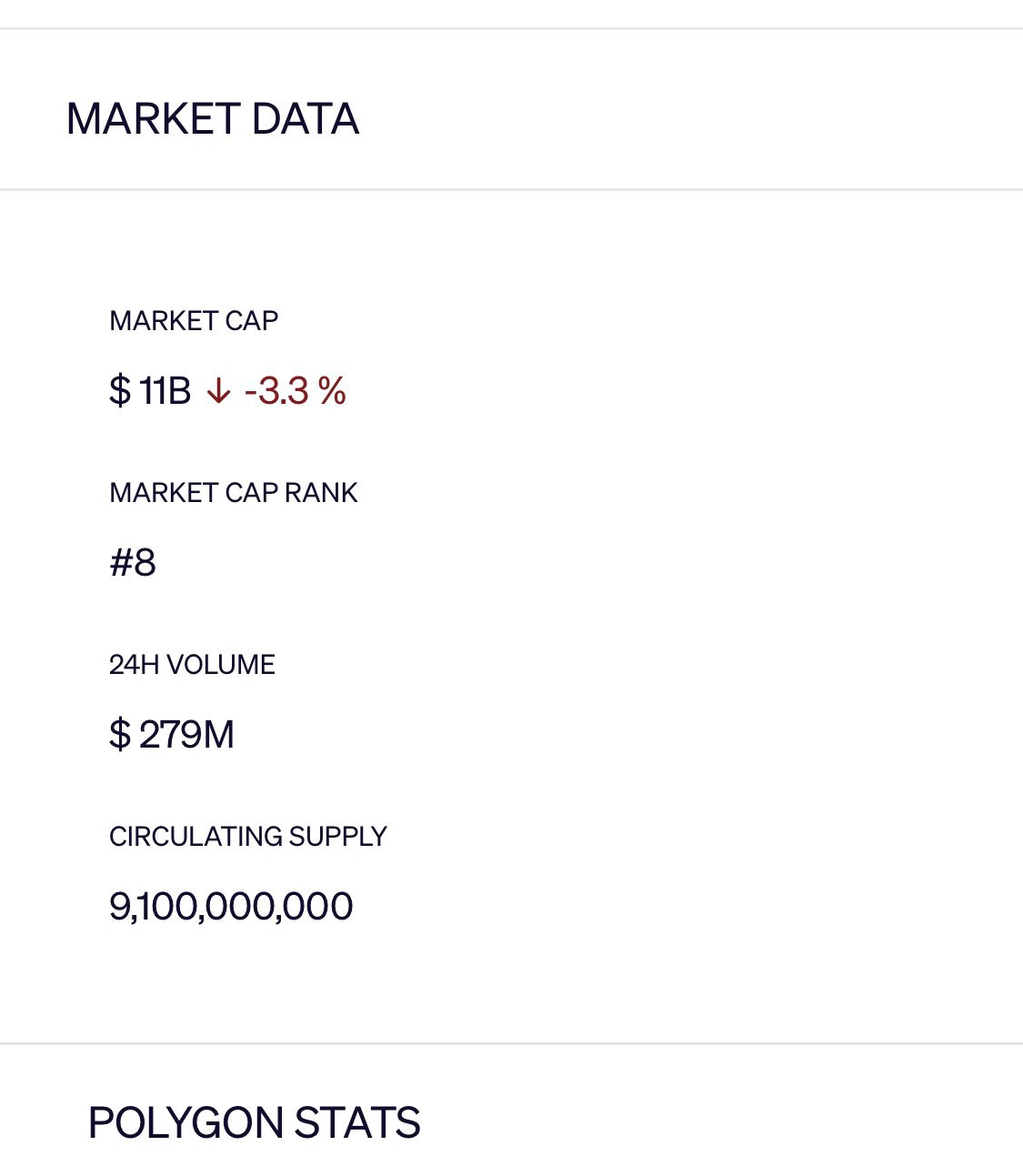

Polygon tokenomics and Op tokenomics

We all know Arbitrum is the chosen one by defi enthusiasts and traders. Even at tech, they’re great with optimistic rollup tech and currently building orbit an L2, for L3 infra. Whoever holds the tokens governs the chain; the whales awake.

Sybilors dump, Yh, whales buy, and listings go brrr. That’s the psychological price prediction.

My price prediction is backed by data and mathematics

Let’s go mathematical.

I’ll compare this (TVL / circulating supply) * 10 = Polygon price (1.08b/9b) * 10 = 1.2$ ranges close to 1.17 (current price).

Op price: (TVL/circulating supply) (no 10 cos it’s in millions)

(986 m/315 m) = 3.1 $, which ranges close to 2.74 $

Arb = (1.77/1.162)*10 = 15$ (price ranges here)

OR

Eth MC is *10 of its TVL, same goes for polygon, Bnb, and some others, which you can confirm.

Proof 👇🏻

*10 of Arb tvl is $17.7b

MC Market cap = token * circ supply $17.7b/1.162b = 15.23.

However, it’s good to note that; In the future, more tokens will be released (2% inflation/ yr, arb project DAO airdrops). Comparison with other L2s and Tvl compatriots is speculation but a reasonable argument as the market always determines the price.

ahhhh im bullish again