Crypto News. February 5, 2026

Vitalik says we don’t need new copy pasta evms or L1s but more innovative app chains

Odds of Jesus return doubles overnight on Polymarket

Kalshi head of comms disputed bank analyst report claiming users lose faster than sports gamblers.

Multicoin Capital co-founder, Kyle Samani steps down

Privacy dex, Silhouette launched shielded spot trading on Hyperliquid.

Merkle Trade is winding down after $30B in trading volume. No new positions from Feb 6, all positions close by Feb 10–12, and final revenue plus staked MKL will be redeemable.

Paradigm released a new data explorer that lets users visually analyze prediction markets across platforms like Kalshi and Polymarket

Tether shared their Q4 2025 report showing record USD₮ growth, with $4.4T in on-chain transfer volume, $187B market cap, and 24.8M monthly active users.

Treasury Secretary Bessent clarified that he has no authority to use taxpayer funds to bail out Bitcoin.

CME Group plans to launch CME coin this year

ElevenLabs secured $500M in funding at an $11B valuation, with Sequoia Capital leading the round, a16z quadrupling its stake, and ICONIQ tripling its investment.

Ripple announced that its institutional prime brokerage platform, Ripple Prime, now supports Hyperliquid, providing institutions with enhanced access to on-chain liquidity.

Ethena launched Exchange Points, a new rewards system for Ethena-powered exchanges (like EtherealDEX and HyenaTrade), distributing 100M points weekly per venue for six months, separate from Season 5.

Ventuals launched V2 with a new frontend, offering 24/7 trading on pre-IPO shares, indices, stocks, and commodities, plus prediction markets, earnings data

TRM Labs reaches Unicorn status with $1B valuation after $70M series C.

UBS explores crypto access for private banking clients as part of multi year strategy.

Fidelity Investments launched its stablecoin, Fidelity Digital Dollar (FIDD), available to retail and institutional investors.

Hyperion DeFi will use HYPE tokens as collateral for on-chain options to earn premiums, launching an Institutional Volatility Income Vault with Rysk finance on HyperEVM to generate extra yield beyond staking via HYPE LSTs and stablecoins.

Black Pearl Compute, Cipher Mining’s AI-focused subsidiary, saw $13 billion in orders for its $2 billion bond sale to fund a Texas data center leased to AWS for 15 years.

Spain’s BBVA joined the Qivalis consortium of 12 EU banks to build a regulated euro stablecoin, seeking Dutch central bank approval under MiCA, with a planned H2 2026 launch to challenge dollar stablecoins.

Prediction market platform Opinion raised $20 million in a Series A round with investors including Hack VC, Jump Crypto, Primitive Ventures, and Decasonic.

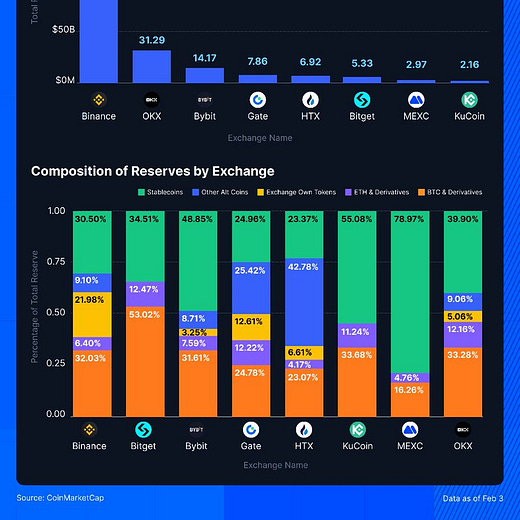

CoinMarketCap’s January 2026 report on exchange reserves ranking places Binance first with $155.64B in total reserves, including $47.47B in stablecoins and $49.84B in Bitcoin-related assets. Following Binance are OKX ($31.29B), Bybit ($14.17B), Gate ($7.86B), HTX ($6.92B), Bitget ($5.33B), MEXC ($2.97B), and KuCoin ($2.16B).

The U.S. Treasury is investigating whether crypto exchanges, stablecoin ramps, and liquidity hubs are enabling Iran to evade sanctions.

SBI Holdings and Startale launches Strium, L1 designed for 24/7 trading of tokenized securities and RWAs