Crypto News. June 17, 2025

Vare Crypto News is live ft Ubyx, EigenLayer, EigenCloud, a16z, Katana, Nansen, etc

Live on YouTube:

https://youtube.com/shorts/En9lKU0cwCI

Live on TikTok:

https://vm.tiktok.com/ZMSaY7yt7/

Please subscribe.

DeFi

The US Senate passed the GENIUS Act, the first real crypto legislation to make it through the US legislation, focused on U.S. dollar backed stablecoin.

Some facts about the bill:

- stables must be fully backed by dollars or liquid assets, with annual audits required for big players (>$50B market cap).

- Stablecoin Holders get first priority in bankruptcy over the issuer if fund collapses.

. Big Tech blocked: Meta, Amazon, etc., can’t issue stables unless they meet heavy risk/privacy regs.

. No yield allowed: Stables must be non-interest bearing, killing DeFi-style rewards on them.

. Foreign issuer scrutiny: Tightens the screws on offshore stables entering U.S. markets.

Bill has Trump admin backing getting heat from Dems over his stablecoin play (World Liberty Financial).

Next stop is the the House, where it faces a potential clash with the STABLE Act.

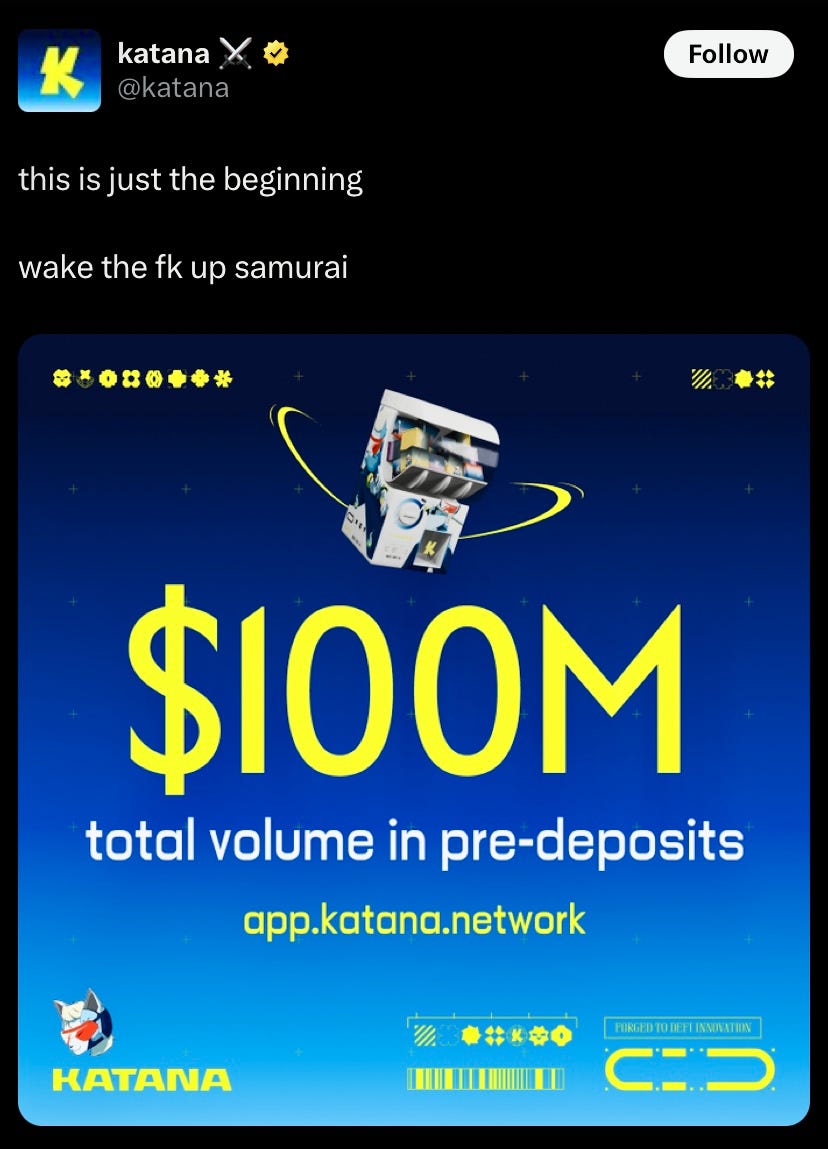

Defi chain, Katana hit $100M in pre-deposits

Iranian exchange Nobitex was hacked for $80M+, with Pro-Israel hacker group Gonjeshke Darande claiming responsibility. The exchange confirmed the breach and pledged full user reimbursement via insurance and internal funds.

Kraken backed Ink L2 is officially launching its INK token with a Hard cap of 1B tokens. Token will be designed for liquidity aggregation + bootstrapping usage across defi dapps. First major use case is an Aave-powered liquidity pool to anchor Ink’s DeFi stack.

Participants of the INK liquidity pool on Aave will be eligible for their upcoming airdrop, hinting at more airdrop campaign

Coinbase Base not interested in launching token, giving Kraken INK an upper hand in the Optimism Superchain competition for market share

Arbitrum currently leads in stablecoin market growth in past 7 days $100M, not thanks to Hyperliquid, but due to Binance increasing its USDC exposure on the network

EigenLayer to launch EigenCloud this week, dubbed the AWS of crypto: a platform designed to build verifiable apps on EigenLayer. Trust as a service for dapps both onchain and off chain

Think of it as a trustless cloud: powered by EigenVerify and EigenCompute (coming soon), it lets devs prove what happened, why, and that it happened, across any domain, from LLMs to medical records to media.

Uses AVS (Autonomous Verifiable Services) + DA to extend crypto-native trust to traditional apps, essentially giving Web2 apps the cryptographic verifiability of Web3

Building for

– Verifiable AI

– Onchain insurance

– Fully onchain games

– Disintermediated marketplaces

– Adjudication + prediction markets

A16z is bullish adding $70M worth of Eigen token

Germany is Alive

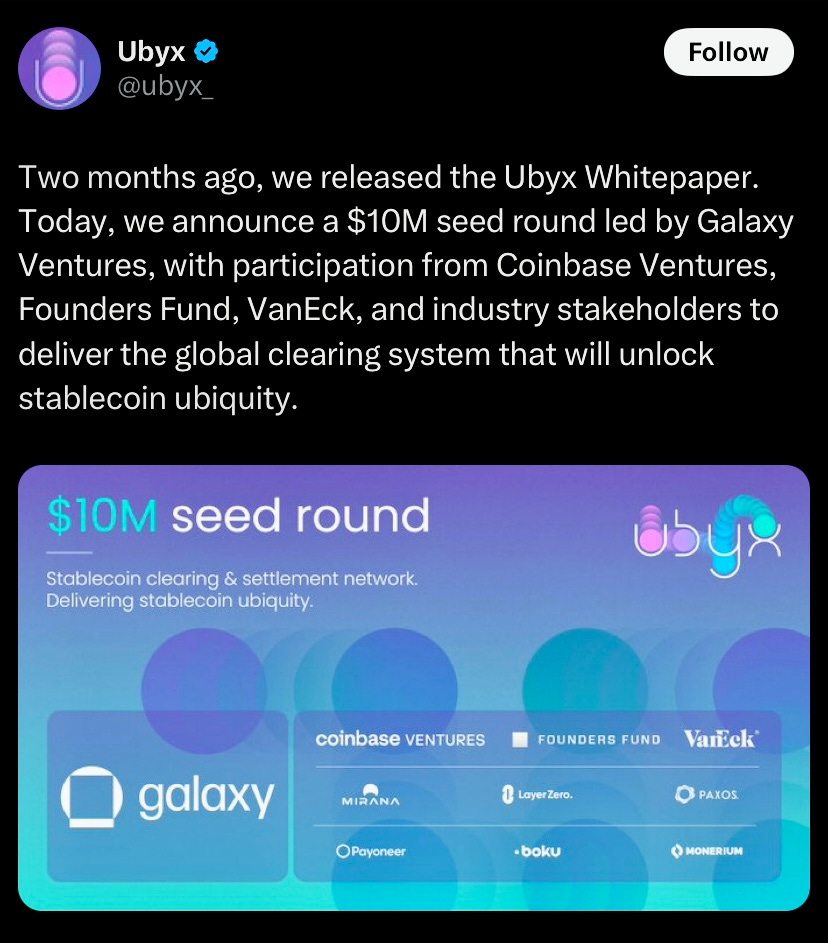

Ubyx, a new stablecoin clearing platform, just closed a $10M seed led by Galaxy Ventures,

They aim to turn stablecoins into cash equivalents by standardizing redemption and making them plug-and-play with TradFi infra. Ramp stablecoin redemption at par, directly into bank and fintech rails, think fiat off-ramp UX for institutions, built to remove friction and unlock mainstream adoption.

Their bullish key partners include Paxos (stablecoin issuer) and Ripple, aiming to plug stablecoins into existing tradfi.

To launch Q4 2025

Nansen launch points program for users ahead of tge, competing with Arkham token market share