Crypto News. June 26, 2025

Vare Crypto News is live ft XRP, Aarna, Gelato, Morpho, Kraken, Maple Finance, Hyperliquid, World Liberty Financial, Bit Digital, Coinbase

Live on YouTube:

https://youtube.com/shorts/mr60lsa3kWQ

Live on TikTok:

https://vm.tiktok.com/ZMSxGujVA/

Please subscribe.

DeFi

COIN hit a new ATH at $369 beating its 2021 NOV ATH of $357. Up 24% in the last 5 days and 40% over the past month.

Big part of the hype comes from Circle’s recent listing (CRCL) has since done 5x from IPO, now trading at $213.63.

Also, recent COIN pump probably comes from their prep announcement. Coinbase is mostly used by Institutions, with perps coming soon.

It’s a competitive prep environment with Hyperliquid and Robinhood in the cut. Hyperliquid has an upper hand with no KYC

Coinbase Derivatives will be launching US perps on July 21: nano BTC (0.01), nano ETH (0.10), 5-year expiry, 24/7 trading, tracks spot price, CFTC-regulated

Plus, Coinbase Derivs will have an added tax advantage compared to other US preps platforms.

Gelato and Morpho collab to dropped embedded crypto-backed loans for wallets, brokers, and fintech apps.

Its a new way for exchanges, wallets, custodians, and apps to embed crypto-backed loans directly into their app

These wallets, fintech apps will be able to launch crypto-backed lending in days without building custody, infra, or auth.

Users will be able to borrow USDC instantly using ETH, BTC, or stables as collateral, all non-custodial, no KYC

Powered by Morpho’s $6.5B lending rails and Gelato’s Smart Wallet SDK EIP-7702, it’s live across on Scroll, Arbitrum, Polygon, Optimism, Base and soon Katana with Web2 style UX (email, passkeys, social logins).

Also, Coinbase recently launched wrapped ADA (cbADA) and LTC (cbLTC) on Base, unlocking these assets for Defi.

Meaning users will be able to send their ADA and LTC from Coinbase to their Base onchain addresses backed 1:1 and fully custodied

This will bring bring ADA and LTC into onchain ecosystems like Morpho, Aave, and Uniswap via Base. Expanding usable collateral in Defi and marking non-EVM assets interoperable with ETH ecosystem.

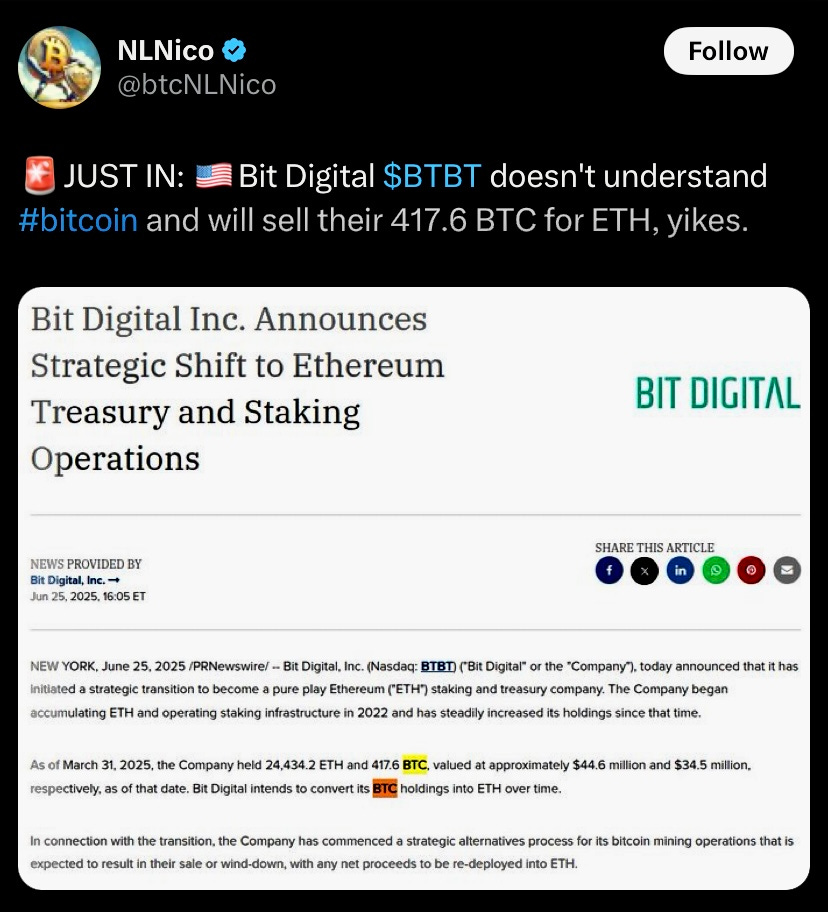

Public BTC miner Bit Digital (BTBT) is going full ETH.

They’ll be exiting BTC mining to become a pure Ethereum staking + treasury play, shifting its BTC stack (417.6 BTC) into ETH over time.

They currently hold 24K+ ETH and already run one of the largest institutional staking ops and now want to lead in ETH native infra: validators, custody, yield, and governance.

It’s one of the first real ETH treasury plays on the public markets. True ETH native treasury plays are rare, asides from Joe Lubin’s SharpLink

There’s a growing trend of firms launching crypto treasury strategies for leveraged exposure to assets like BTC, ETH, and SOL.

Trump backed World Liberty Financial (WLFI) will be making their token transferable soon.

Also, they have an attestation report for its USD1 stablecoin coming in few days.

Trump announced trade deal with China, says India is next.

HYPE is now accepted as collateral on Maple Finance, institutional borrowers can now borrow against their HYPE positions.

Maple is a DeFi lending platform built for institutions, now managing $2.4B AUM and $1.6B TVL (as of June 2025) focusing on low-collateral loans and RWAs like tokenized US Treasuries

Retail can earn a stable 6.4% APY through SyrupUSDC, a yield product backed by overcollateralized loans (50%+ LTV)

After a bad 2022, they are focused on deploying more cash into loans.

Hyperliquid gUNIT

Galaxy Asset Management has closed a $175M raise for its new fund, Galaxy Ventures Fund I, targeting early-stage investments in blockchain, infra, and financialized apps.

The fund aims to back ~30 top digital asset startups, with capital from institutions, family offices, and high net worth individuals.

Kraken launched Krak, a global payments app, facing competitors Venmo, PayPal, and Cash App.

Krak offers free local and international payments in 160+ countries, up to 4.1% APY on USDG, and 10% staking rewards.

The app will also include a crypto credit line, Krak cards (physical + virtual), and Kraktags: an ENS-style usernames for easy transfers.

Kraken needs more products as it gears up for IPO

XRP army

XRP Ledger integrates Wormhole, unlocking multichain access to 25+ blockchains

XRPL now taps Axelar for sidechain bridging, Flare for XRP staking, and Wormhole for web3 interoperability.

Sharing Aarna whitelist

ATVPHNG, ATVDFB8, ATVTBFZ, ATVPJ95, ATVKLYO, ATVDPPM, ATV6YVZ, ATVCRWD, ATV5JDP, ATVK4VU

Part of Circle’s 2025 USDC Grant Program.

Their flagship vault, âtv111, just went live with pre-deposits open until July 15, offering 20%+ APY on USDC plus up to 4× $AARNA reward multipliers. It’s AI-native, on-chain, and built for capital efficiency.

Future yield is tokenizable via Pendle, usable as collateral on Euler/Morpho, and pluggable into upcoming aarnâ lending.

Live on Ethereum and Sonic, then on Base, Arbitrum, and Solana.

Aarna is led by Sri Misra (2021 Yale World Fellow)