Crypto News. June 30, 2025

Vare Crypto News is live ft Maple Finance, Robinhood, xStocks, Circle, Katana, Paxos, Deutsche Bank, Vooi, Botanix labs etc

Live on YouTube:

https://youtube.com/shorts/o1NxvMjt3tU

Live on TikTok:

https://vm.tiktok.com/ZMSXfDYgH/

Please subscribe.

DeFi

The US SEC has approved conversion of Grayscale Digital Large Cap Fund LLC into a Spot ETF that holds BTC, ETH, XRP, ADA, SOL

This will start a ripple effect for other crypto fund proposals.

The Grayscale fund, currently trades OTC for accredited investors, and is composed of 80% Bitcoin, 11% ETH, and smaller caps of Solana, Cardano, and XRP.

Bitfinex backed L1 Stable unveil phase 1 of its roadmap. It’ll use USDT as its native token for gas and settlement fees. Aimed at solving inefficiencies like high fees and slow settlements, Stable will offer sub second block finality, full EVM compatibility, and gas free transactions via a LayerZero based USDT0 token. It also includes institutional features such as guaranteed blockspace, confidential transfers, and a native wallet with social login and card integration.

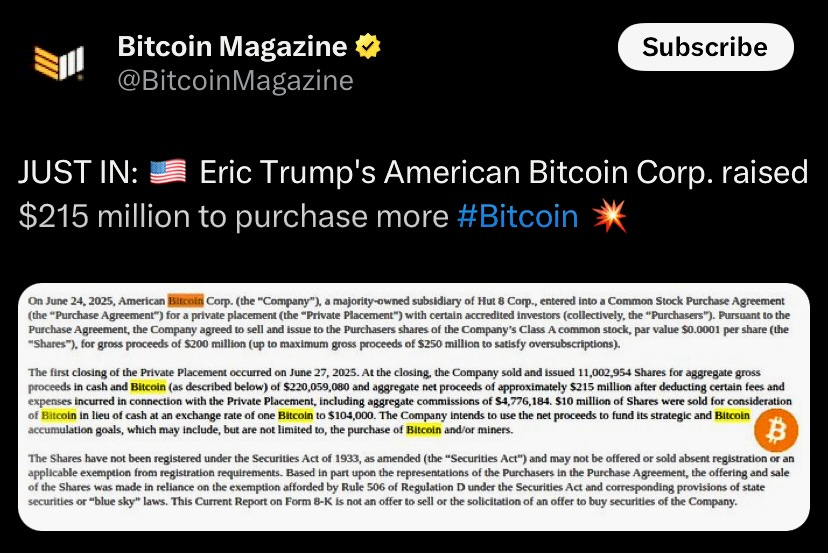

Eric Trump and Donald Trump backed American Bitcoin, a newly launched mining firm, has raised $220M through a private placement of over 11 million new shares.

Botanix Labs Spiderchain is live on mainnet. With support from GMX and Dolomite, Spiderchain aims to bring Bitcoin security to EVM dapps using a decentralized, multisig-based security model.

They launched a 16-node founding federation of node Operators. Thime federation includes Alchemy, Antpool, and Galaxy, FireBlocks, Kiln, Chorus One, Antpool etc with plans to expand to over 100 operators by 2026.

Vooi, the perps DEX backed by YZi Labs, has launched its V2 mainnet, introducing crosschain trading through chain abstraction.

It’ll offer unified access to multiple perp exchanges including Hyperliquid, Orderly, and SynFutures, via a single trading terminal.

Vooi integrated OneBalance chain abstraction toolkit to remove the need for chains, bridges, or native gas fees, streamlining the UX across networks.

Deutsche Bank plans to launch a crypto custody service next year.

The bank is working with EU crypto broker, Bitpanda, and Taurus, a Deutsche Bank backed digital asset infrastructure provider.

Paxos has launched USDG, a dollar-pegged stablecoin for EU users, backed by Robinhood, Kraken, Galaxy Digital, and Anchorage. Issued by a regulated Finnish entity under the EU’s MiCA framework, USDG will offer one-to-one redemption and partial reserves held in EU banks.

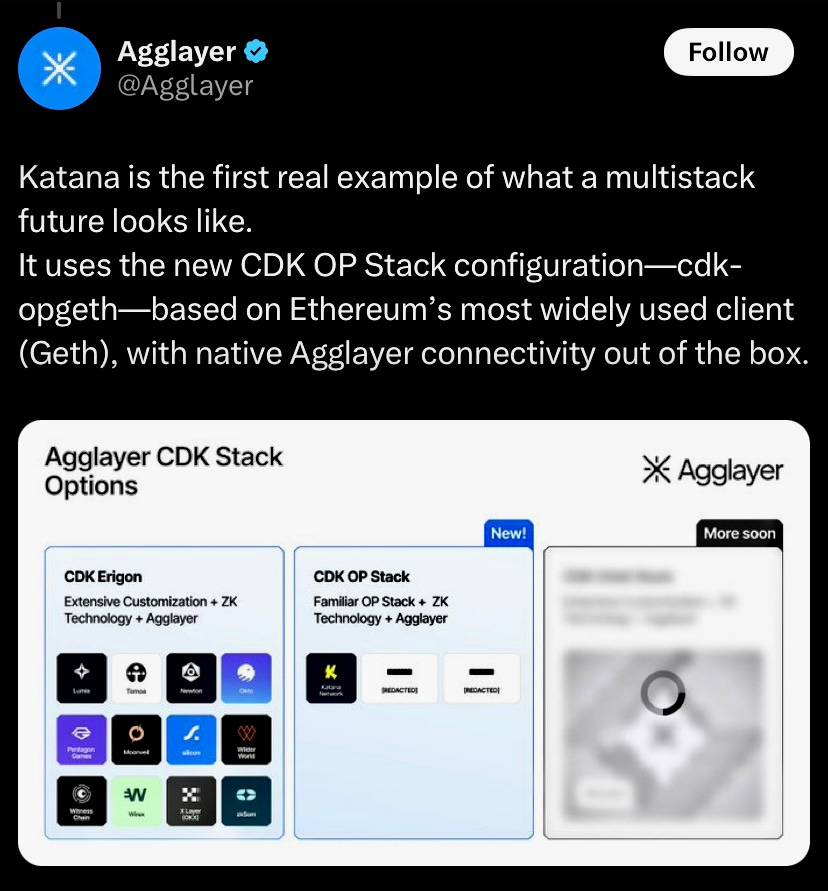

DeFi chain Katana is now live on mainnet. Incubated by Polygon Labs and GSR, it uses a custom OP Stack variant called cdk-opgeth and connects to AggLayer’s Vault Bridge for cross chain interoperability.

Katana is aimed to become a deep liquidity hub for AggLayer connected chains, enabling seamless liquidity access and potentially generating significant fee revenue for POL stakers.

Circle has applied for a national banking license. If approved by the US Office of the Comptroller of the Currency (OCC), Circle—operating as First National Digital Currency Bank— would be able to securely hold its reserves and manage crypto assets for institutional clients. However, this license wouldn’t allow them to take deposits or offer loans like a traditional ban.

Maple has added EtherFi’s weETH as collateral for its on chain credit platform. This will allows qualified borrowers to access USDC loans while earning ETHFI rewards. To encourage adoption, Maple is offering a 2% APY rebate in ETHFI on the first $50 million in weETH-backed loans. These overcollateralized loans have a two-month term and a $5 million minimum size, providing a new liquidity option for weETH holders.

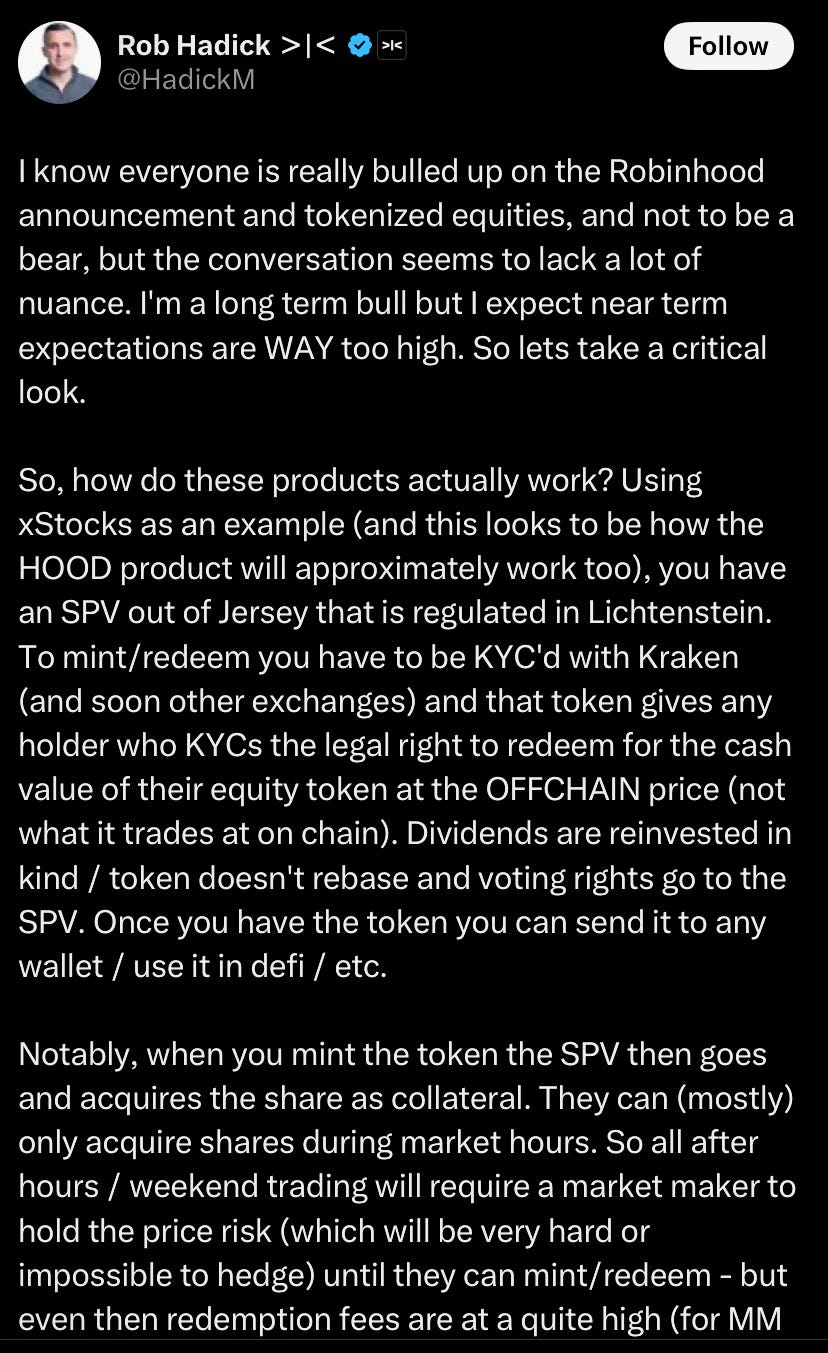

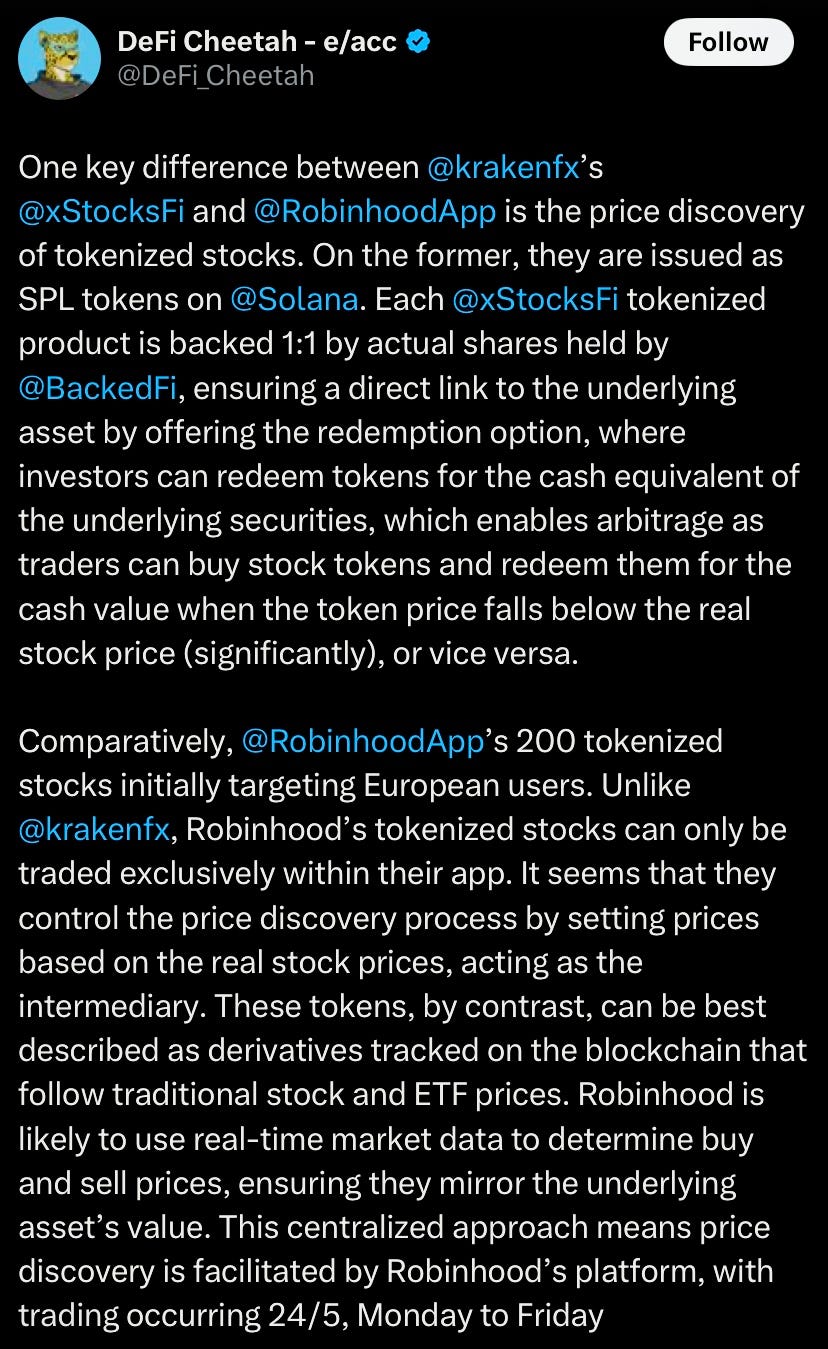

Both Kraken and Robinhood are bringing tokenized stocks into market with different approaches, Kraken’s @xStocksFi goes with a decentralized way to trade tokenized stocks on Solana, while Robinhood’s uses centralized distribution targeting European users.

Robinhood on EthCC announced it’ll launch 200+ tokenized US stocks and ETFs on Arbitrum for users in Europe, complete with in app dividends and perpetual futures trading. They’re also bringing ETH and Solana staking to the US and Europe, and working on their L2 built on Arbitrum.

On the other hand, Kraken’s xStocks is already live on Solana, backed 1:1 by real shares and held by a custodian. Investors can redeem tokens for the actual cash value of the shares, allowing true arbitrage, creating a decentralized price discovery mechanism.

Robinhood’s can only be traded within Robinhood’s app. Robinhood controls pricing directly, basing token prices on real stock prices and acting as an intermediary. So, they’re more like blockchain based derivatives with centralized price control and trading limited to regular market hours.