Crypto News. November 5, 2025

Monad to launch mainnet and airdrop on Nov 24

World Liberty financial partners with Bonk and Raydium to power USD1 on Solana

Gemini is planning to launch prediction market contracts

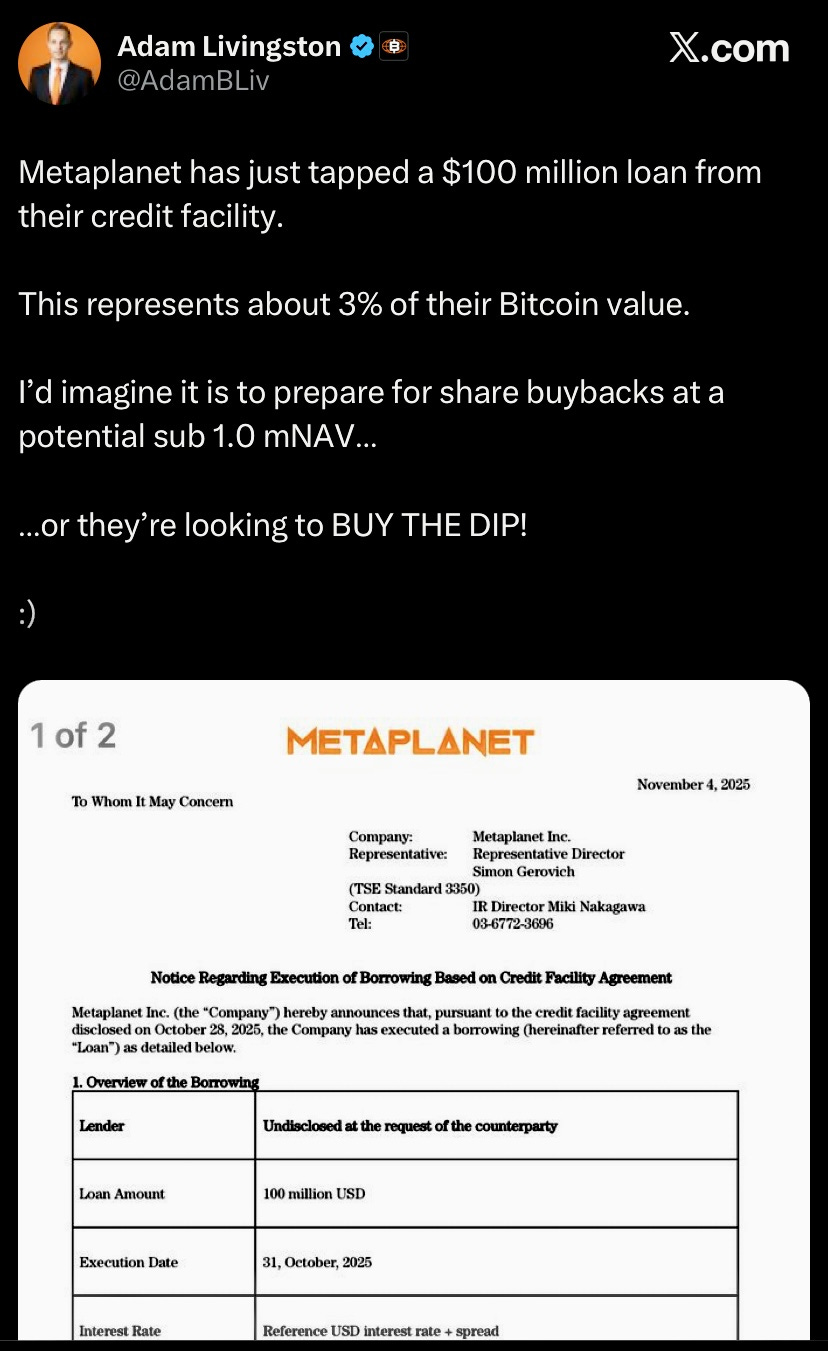

Metaplanet secured a $100M loan (3% of its Bitcoin holdings) using its Bitcoin as collateral to buy BTC dip

Berachain recovered $12.8M stolen in a hack with help from a white hat hacker who will be rewarded. The network is operational, HONEY token trading resumed, but BEX withdrawals remain restricted while the team prepares compensation plan and infra upgrades.

Ripple secured a $500M investment at $40B valuation led by Fortress Investment Group and Citadel Securities

Ripple teamed up with Mastercard, WebBank, and Gemini to enable RLUSD settlement on the XRP Ledger for fiat credit card txns

RedStone launched HyperStone, a dedicated oracle providing fast, reliable price feeds for permissionless perpetual markets on Hyperliquid’s HIP-3 framework.

Tokenization platform Dinari has partnered with Chainlink to tokenize S&P DJI’s forthcoming Digital Markets 50 Index onchain

Metaplanet's move to leverage only 3% of their Bitcoin holdings for a $100M loan is pretty smart risk managment. This kind of conservative leverage lets them buy more BTC during dips without overextending. It shows how far institutional adoption has come when companies can actually use their Bitcoin holdings productively instead of just hodling.

Intesting to see institutional activity with Metaplanet using Bitcoin as collateral. Payment coins like Bitcoin Cash could benefit from this trend as more companies look for liquidity solutions. BCH's low fees make it ideal for actual transactions compared to collateral plays.