The Truth About ETH Withdrawals During Shanghai: Separating Fact from Fud

The media and fudders tell you that 17 million ETH ($28 billion) will be unstaked during Shanghai.

All ye ETH maxis, not to worry, we'll put those FUDers in their place! Just remember: ETH Maxis and Believers unite, together we'll make FUD fly away like a kite!

This is the truth!

Shanghai is the upgrade for ETH's EL (execution layer), while Capella is the upgrade for the Consensus Layer (CL) or the Beacon Chain. However, since these upgrades will occur simultaneously, Shanghai refers to both. While there are other EIPs included in Shanghai, the most significant one is the ETH withdrawal.

Since December 2020, when the Beacon Chain was launched, validators were able to stake ETH, but withdrawals could not be initiated, which put social pressure on EF devs. After the usual ACDC in December last year, ETH withdrawals were slated for March 2023. However, they have been pushed to April.

Now, let's get into the details of things.

Due to the design of the Merge and fusion of Beacon Chain with ETH, all validators are required to update their withdrawal credentials to the 0x01 format in order to withdraw.

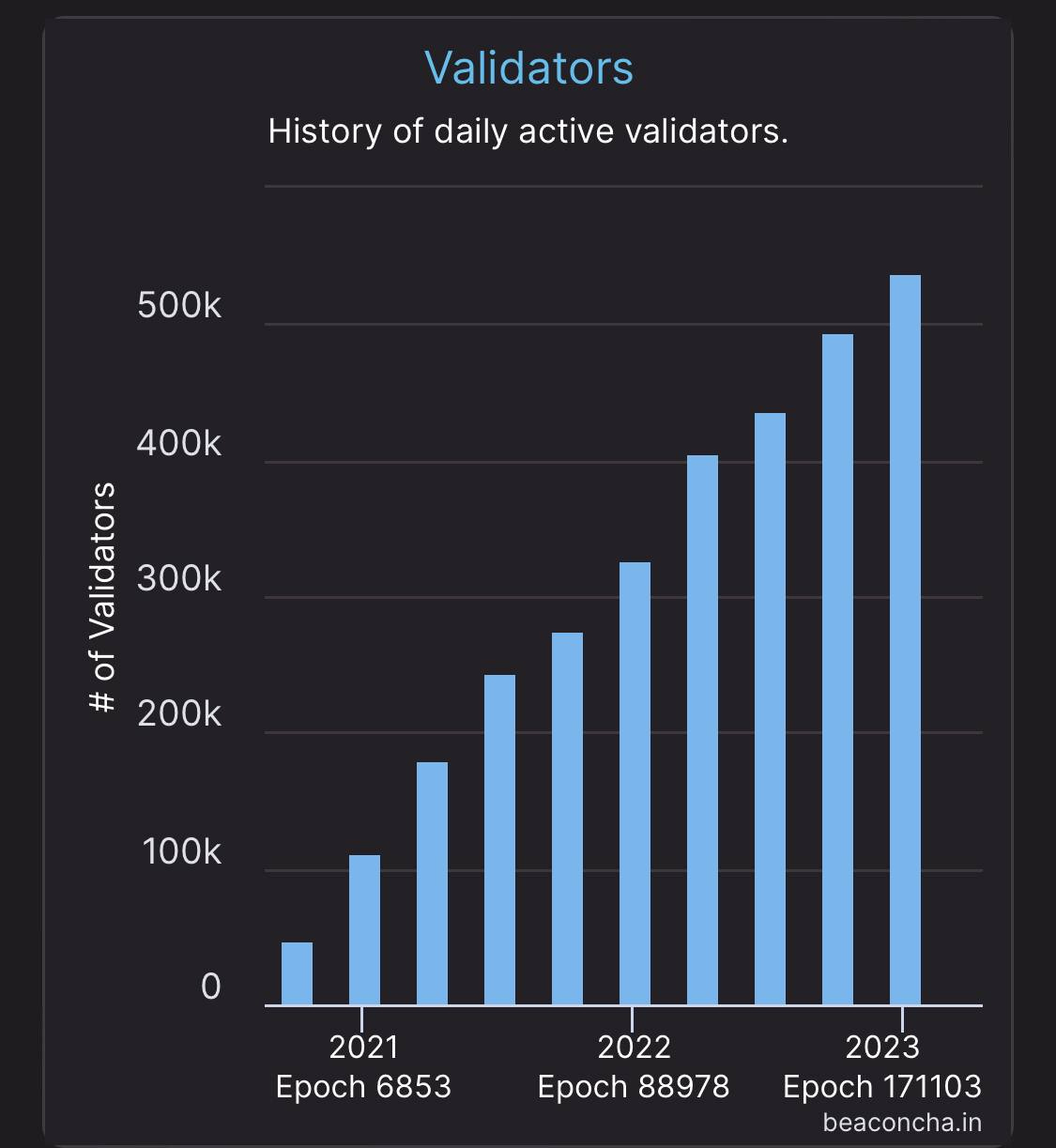

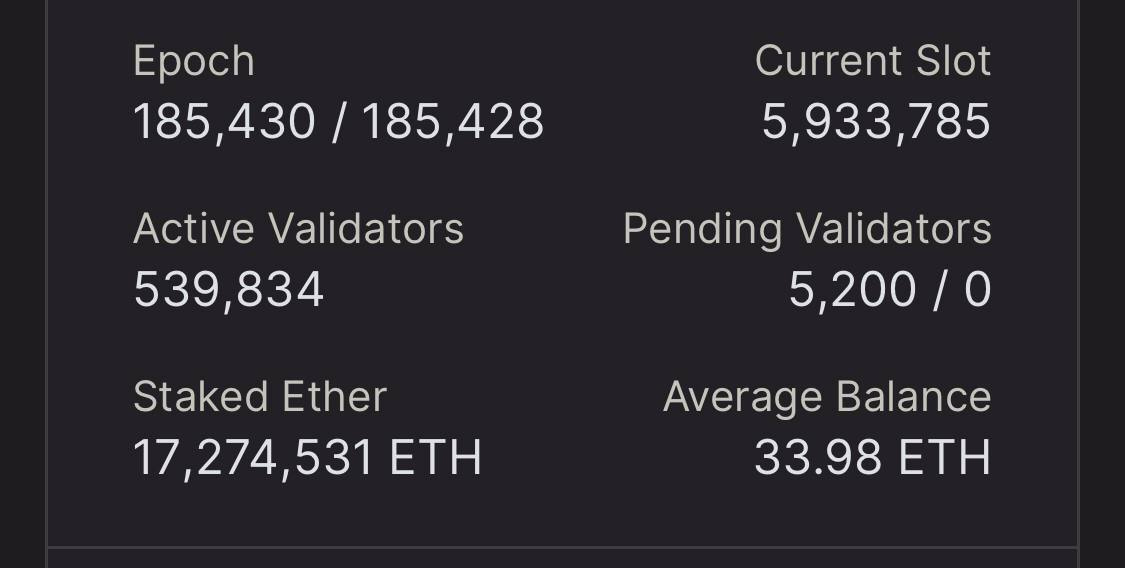

According to ETH code dev @benjaminion_xyz, there are approximately 302,154 validators with 0x00 credentials and 186,722 with 0x01 credentials. Once Shanghai is live, the ETH network will process 16 full or partial withdrawals on each block, which is produced every 12 seconds. This means it will take approximately 104 hours for the network to process all withdrawals for the whole ~500k validators on the beacon chain.

Note: A validator's credential must be 0x01 for a withdrawal to be processed.

Before we go further, let me make things clear, if I’m not mistaken these are the facts surrounding partial and full withdrawal

* A partial withdrawal allows a validator to withdraw only a portion of their staked ETH, while a full withdrawal allows them to withdraw their entire staked ETH balance.

* Validators can initiate a partial or full withdrawal from the Beacon chain once they have met the requirements for withdrawal— having their validator node online, attesting to blocks for a minimum of 256 epochs, and a 0x01 credential.

* After a partial or full withdrawal has been initiated, the staked ETH will become locked for a certain period of time before it can be withdrawn.

* This period is currently set to 4 epochs, which is equivalent to approximately 24 minutes.

* Validators can initiate multiple partial withdrawals, but they can only have one full withdrawal in progress at a time.

* If a validator initiates a full withdrawal while a partial withdrawal is already in progress, the partial withdrawal will be canceled.

Yes, 17.2M ETH is staked in the Beacon chain, but I have this to say 👇🏻

Data from Defillama says 7.6M ETH is staked with LSD.

P.S. 7.6M ETH has been illiquid the whole time 😼

Now, let's do some simple math. Subtracting 7.6M ETH from 17.2M ETH leaves 9.6M ETH. Will this 9.6M ETH be withdrawn?

Let's go back in time. The total number of ETH staked in December was 1.4m ETH; data was obtained from the beacon chain contract via Etherscan.

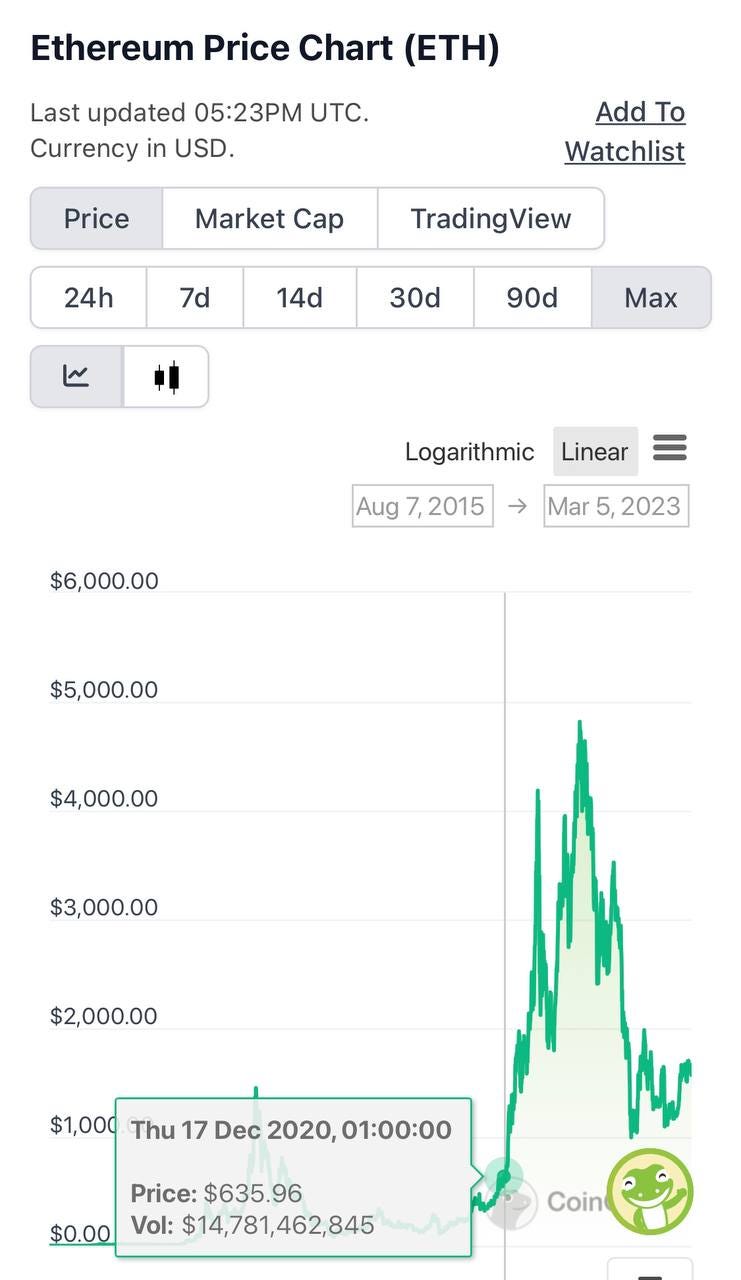

From data from CoinGecko, the average price of ETH from Dec 1st to Dec 31st when the Beacon chain launched was $681.10.

The current price of ETH is $1,570, so they are all in profit. Will 1.4m ETH be unstaked? Currently, there are 1,084 validators who have exited the beacon chain. 864 left voluntarily, while 220 were slashed out. Once Shanghai resumes, 34,688 ETH (corresponding to the 1,084 validators who have exited the beacon chain) will be unstaked automatically.

From this data, only 884 out of 500k validators left voluntarily. The remaining are bullish long-term and enjoy the yield.

In December 2020, 1.4 million ETH were staked in the Beacon chain without any news of withdrawals or fear of an ETH dump. Using psychological analysis, it is suspected that the stakers are bullish long term and want more ETH.

Staking pools and centralized exchanges (CEXs) have gotten involved, with conflicting data between DeFiLlama and Etherscan on liquid staking. DeFiLlama lists Coinbase as a liquid staking platform, which is true.

CEXs and some staking pools follow a design where stakers don't get immediate withdrawals and have locked stakes, resulting in less sell pressure. Liquid staking has no sell pressure, as it has always been liquid.

The total percentage of liquid staking, CEXs, and staking pools is 69.6%, which amounts to 11.9 million ETH out of the 17 million ETH staked in the Beacon chain. This leaves 5.3 million ETH for whales and others.

Whales staked a lot, so they are long-term holders and quite bullish. However, some may sell. It is unknown how many ETH will be withdrawn, as withdrawals will be queued up with rules and restrictions guiding them.

As for where the withdrawn ETH will flow, it is likely to seek more yield. This leads to the next article on LSD and Shanghai.

sources

https://www.galaxy.com/research/insights/100-days-after-the-merge/

https://notes.ethereum.org/@launchpad/withdrawals-faq#ETH-Withdrawals-FAQ